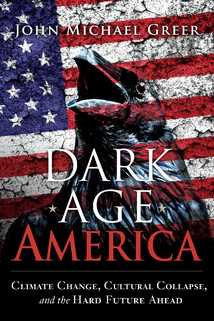

The coming of peak oil is driven by geological factors, not political ones, but the cascade of consequences that will follow the peaking and decline of world petroleum production can’t be understood outside the context of politics, on global, local, and personal scales. As a religious leader who believes devoutly in the separation of church and state, it’s been my practice to keep politics out of these commentaries, in the probably vain hope that other clergypersons will notice one of these days that the barrier between religion and politics is there as much to protect them from politicians as it is to keep them from abusing their own positions. Still, it’s impossible to make sense of peak oil outside of its political context, and so a few words on the subject can’t be avoided here. This is especially true on the global level, the subject of this week’s Archdruid Report, where the preeminent political fact of the age of peak oil is the impending decline – and, at least potentially, the catastrophic collapse – of America’s world empire.

Empires are unfashionable these days, which is why those who support the American empire generally start by claiming that it doesn’t exist, while those who oppose it seem to think that the simple fact of its existence makes it automatically worse than any alternative. I have a hard time finding any worth in either of these views. When the United States maintains military garrisons in more than a hundred nations, supporting a state of affairs that allows the 5% of humanity who are American citizens to monopolize something like a third of the world’s natural resources and industrial production, it’s difficult to discuss the international situation honestly without words like “empire” creeping in, and it requires a breathtaking suspension of disbelief to redefine American foreign policy as the disinterested pursuit of worldwide democracy for its own sake.

Still, portraying American empire as the worst of all possible worlds, a popular sport among intellectuals on the left these days, requires just as much of a leap of faith. If Nazi Germany, say, or the Soviet Union had come out on top in the scramble for global power that followed the decline of the British Empire, the results would certainly have been a good deal worse, and those who currently exercise their freedom to criticize the present empire would face gulags or gas chambers. The lack of any empire at all may very well be a desirable state of affairs, of course, but until our species evolves efficient ways to checkmate the ambitions of one nation to exploit another, that state of affairs is unlikely to obtain this side of Neverland.

The facts of the matter are that ever since transport technology evolved far enough to permit one nation to have a significant impact on another, there have been empires; since the rise of effective maritime transport in the 15th century, those empires have had global reach; and since 1945, when it finished off two of its rivals and successfully contained the third, the United States has maintained a global empire. That empire was as much the result of opportunism, accident and necessity as of any deliberate plan, but it exists, and if it did not exist, some other nation would fill a similar role. So, like it or not, America rules the dominant world empire today – and that will likely become a source of tremendous misfortune for Americans in decades to come.

Partly this comes from the nature of imperial systems, because the pursuit of empire is as self-destructive an addiction as anything you’ll find on the mean streets of today’s inner cities. The systematic economic imbalances imposed on client states by empires, while hugely profitable for the empire’s political class, wreck the economy of the imperial state by flooding its markets with cheap imported goods and its financial system with tribute. Those outside the political class become what A.J. Toynbee, in his A Study of History, calls an internal proletariat, alienated from an imperial system that yields them few benefits and many burdens, while the external proletariat – the people of the client states, whose labor supports the imperial economy but who gain little or nothing in return – respond to their exploitation with a rising spiral of violence that moves from crime through terrorism to open warfare. To counter the twin threats of internal dissidence and external insurgency, the imperial state must divert ever larger fractions of its resources to its military and security forces. Economic decline, popular disaffection, and growing pressures on the borders hollow out the imperial state into a brittle shell of soldiers, spies, and bureaucrats surrounding a society in freefall. When the shell finally cracks – as it always does, sooner or later – nothing is left inside to resist change, and the result is implosion.

It’s possible to halt this process, but only by deliberately stepping back from empire. Britain’s response to its own imperial sunset is instructive; instead of clinging to its empire and being dragged down by it, Britain allied with the rising power of the United States, allowed its colonial holdings to slip away, and managed to keep its economic and political system more or less intact. Compare that to Spain, which had the largest empire on Earth in the 16th and 17th centuries. By the 19th century it was one of the poorest countries in Europe, two centuries behind the times economically, racked by civil wars and foreign invasions, and completely incapable of influencing the European politics of the age. The main factor in this precipitous decline was the long-term impact of empire. It’s no accident that Spain’s national recovery only really began after its last overseas colonies were seized by the United States in the Spanish-American war.

In this light, the last quarter century of American policy has been suicidally counterproductive in its attempt to maintain the glory days of empire. That empire rested on three foundations – the immense resource base of the American land, especially its once-huge oil reserves; the vast industrial capacity of what was once America’s manufacturing hinterland and now, tellingly, is known as the Rust Belt; and a canny foreign policy, codified in the early 19th century under the Monroe Doctrine, that distanced itself from Old World disputes and focused on maintaining exclusive economic and military influence over Latin America. With these foundations solidly in place, America could intervene decisively in European affairs in 1917 and 1942, and launch an imperial expansion after 1945 that gave it effective dominance over most of the world.

By 1980, though, the economic impacts of empire had already gutted the American industrial economy – a process that has only accelerated since then – and the new and decisive factor of oil depletion added substantially to the pressures toward decline. A sane national policy in this context might have withdrawn from imperial commitments, shifted the burdens of empire onto a resurgent western Europe, pursued military and economic alliances with rising powers such as China and Brazil, and used the economic and social turmoil set in motion by the energy crises of the 1970s to downshift to less affluent and energy-intensive lifestyles, reinvigorate the nation’s industrial and agricultural economy, and renew the frayed social covenants that united the political class with other sectors of the population in a recognition of common goals.

The realities of American politics, however, kept such a plan out of reach. In a society where competing elite groups buy political power by handing out economic largesse to sectors of the electorate – which is what “liberal democracy” amounts to in practice – the possibility of a retreat from empire was held hostage by a classic prisoner’s dilemma: any elite group willing to put its own short-term advantage ahead of national survival could take and hold power, as Reagan’s Republicans did in 1980, by reaffirming the imperial project and restoring access to the rewards of the tribute economy. For that reason, especially since 2000, the American political class – very much including its “liberal” as well as its “conservative” factions – has backed the survival of America’s global empire by all available means.

This would be disastrous even without the factor of peak oil. No empire, even in its prime, can afford policies that estrange its allies, increase its overseas commitments, make its enemies forget their mutual quarrels and form alliances with one another, and destabilize the world political order, all at the same time. American foreign policy in recent years has accomplished every one of these things, at a time when America’s effective ability to deal with the consequences is steadily declining as its resource base dwindles and the last of its industrial economy fizzles out. To call this a recipe for disaster is to understate the case considerably.

Peak oil, though, is the wild card in the deck, and at this point in the game it’s a card that can only be played to America’s detriment. To an extent few people realize, every aspect of American empire – from the trade networks that extract wealth from America’s client states to the military arsenal that projects its power worldwide – depends on cheap abundant petroleum. As the first nation to systematically exploit its petroleum reserves on a large scale, the United States floated to victory in two world wars on a sea of oil, and learned the lesson that the way to win wars was to use more energy than the other side. That was possible in the first half of the 20th century, when America was the world’s largest oil producer and exporter. It became problematic in the 1970s, when domestic oil production peaked and began to decline, while consumption failed to decline in step and made America dependent on imports. The arrival of worldwide peak oil completes the process by making America’s energy-intensive model of empire utterly unsustainable.

How that process will play out is anyone’s guess at this point. What worries me most, though, is the possibility that it could have a very substantial military dimension. The US military’s total dependence on energy-intensive high technology could too easily become a double-edged sword if the resources needed to sustain the technology run short or become suddenly unavailable, and its investment – economic as well as intellectual – in a previously successful model of warfare could turn into a fatal distraction if new conditions make that model an anachronism.

Any student of history knows that people in each age tend to overestimate the solidity of the familiar, and are commonly taken by surprise when the foundations of an established order melt out from beneath them. The possibility that the global political scene could change out of all recognition in the aftermath of military catastrophe is hard to dismiss, and if that happens those of us who live in today’s United States could be facing a very rough road indeed.

Thursday, October 26, 2006

Wednesday, October 18, 2006

Public Health: Slow Motion Disaster

Of the four aspects of our deindustrial predicament I outlined in a previous post – fossil fuel depletion, economic contraction, declining public health, and political dysfunction – public health has received far and away the least attention from the peak oil community. This is ironic, to use no stronger word. I’ve argued at length elsewhere that the energy shortages and economic breakdowns sometimes claimed as causes of imminent industrial collapse will play out instead over decades of unsteady decline, and taken a certain amount of heat from apocalyptically minded peak oil theorists for that. Here, though, the shoe is on the other foot. Though it’s all but unnoticed outside of a small cadre of worried professionals, the disintegration of public health in coming decades promises a disaster in slow motion.

It’s not surprising that this particular crisis has gotten so little air time. Public health is one of the least regarded, though among the most necessary, of the basic services industrial society provides its citizens. It’s not exciting stuff. Sanitation, pest control, water treatment, food safety regulations, and the like are exactly the sort of humdrum bureaucratic activities that today’s popular culture ignores most readily. Even infectious disease control rarely achieves the level of intensity chronicled, say, in Randy Shilts’ history of the AIDS epidemic, And The Band Played On; more often it’s a matter of collecting statistics, tracing contacts, and sending emails to local officials and hospitals in the certain knowledge that most of the recipients will just hit the delete button. On these pedestrian activities, though, rests the industrial world’s relative freedom from the plagues that visited previous societies so regularly and killed so many of our ancestors.

The impending collapse of public health, like most aspects of our current predicament, has an abundance of causes. One is the failure of government at all levels to maintain even the very modest support public health once received. Lacking an influential constituency in the political class, public health departments far more often than not came out the losers in the tax and budget struggles that dominated American state and local politics in the last quarter of the 20th century. Worse, food safety regulations were among the consumer protections gutted by business-friendly politicians, with results that make the headlines tolerably often these days.

A second factor in collapsing public health is the end of the antibiotic age. Starting in the early years of the 20th century, when penicillin revolutionized the treatment of bacterial infections, antibiotics transformed medical practice. Dozens of once-lethal diseases – diphtheria, tuberculosis, bubonic plague, and many others – became treatable conditions. A few prescient researchers cautioned that microbes could evolve resistance to the new “wonder drugs” if the latter were used too indiscriminately, but their warnings went unheard amid the cheerleading of a pharmaceutical industry concerned only with increasing sales and profits, and a medical system that became little more than the pharmaceutical industry’s marketing arm. The result has been an explosion of antibiotic-resistant microbes. The media not long ago announced the emergence of XDR (extreme drug resistant) tuberculosis in Africa and Asia, adding to the list of microbes even the best modern antibiotics won’t treat.

A third and even more worrisome factor is the impact of ecological disruption on patterns of disease. As the number of people on an already overcrowded globe spirals upwards, more and more of the earth’s wild lands come under pressure, and microbes that have filled stable ecological niches since long before our species arrived on the scene end up coming into contact with new hosts and vectors. HIV, the virus that apparently causes AIDS, seems to have gotten into the human population that way; Ebola and a dozen other lethal hemorrhagic fevers certainly did, along with many others. At the same time, global warming driven by our smokestacks and tailpipes has changed distribution patterns of mosquitoes and other disease vectors, with the result that malaria, dengue fever, and other tropical diseases are starting to show up on the edges of today’s temperate zones.

Add the impact of fossil fuel depletion on these three factors and the results are unwelcome in the extreme. In a future of soaring energy costs and crumbling economies, public health is pretty much guaranteed less access to local government budgets than it has now, meaning that even the most basic public health services are likely to go by the boards. The same factors make it unlikely at best that pharmaceutical companies will be able to afford the expensive and resource-intensive process of developing new antibiotics that has kept physicians one step ahead of most of the antibiotic-resistant microbes so far. Finally, ecological disruption will only increase as a world population dependent on petroleum-based agriculture scrambles to survive the end of cheap oil, and the likelihood that many countries will switch to coal means that global warming will likely go into overdrive in the next few decades.

The inevitable result is the return of the health conditions of the 18th and 19th century, when deadly epidemics were routine events, childhood mortality was common, and most people could expect to die from infectious diseases rather than the chronic conditions that fill the “cause of death” slot on most death certificates these days. Factor in soaring rates of alcohol and drug abuse, violence, and malnutrition – all of them inevitable consequences of hard economic contraction – and you have a situation where the number of people on the planet will take a sharp downward turn. Statistics from Russia, where a similar scenario played out in the aftermath of the Soviet Union’s collapse, suggest that population levels could be halved in less than a century. This doesn’t require massive epidemics or the like; all it takes is a death rate from all causes well in excess of the birth rate, and that’s something we will certainly have as the deindustrial age begins.

The role of modern medicine in these transformations is complex. Especially in America, but not only there, economic forces long ago turned the theoretical triumphs of scientific medicine into a real-world fiasco. For well over a decade now, medical care has been the leading cause of death in the United States – add together the annual death toll from iatrogenic (physician-caused) diseases, nosocomial (hospital-transmitted) infections, drug side effects and interactions, risky but heavily advertised elective surgeries such as stomach stapling, and simple malpractice, and the resulting figure soars well above the annual toll for heart disease, or cancer, or anything else. As economic decline puts mainstream medical care out of reach of most people, death rates from these causes will drop correspondingly, and at least in the industrial world this may cushion the impact of the factors just discussed for a while.

Many people are already voting with their feet by abandoning conventional medicine for various alternative and traditional forms of medicine. Even when these don’t work – and of course some of them don’t – placebos are at least less likely to cause harm than the toxic drugs and invasive surgeries that form the mainstay of today’s conventional medicine. Many alternative health care systems, on the other hand, treat common illnesses quite effectively. Another factor, though, makes alternative methods much better suited to the coming deindustrial age than scientific medicine. Today’s medical system is among industrial civilization’s most voracious users of energy and natural resources; almost without exception, alternative medical treatments use much less of both. Many of the most effective alternative systems – herbalism and acupuncture come to mind – evolved long before the industrial system came into being and use very modest amounts of sustainable resources to treat illnesses. In an age of energy scarcity and hard ecological limits, systems like these are the wave of the future.

The tangled roots of the public health crisis make it a particular challenge to prepare for on an individual basis. Some things can certainly be done. A solid knowledge of first aid, nutrition, sanitation, and basic nursing procedures will go a long way. Sensible eating and healthy exercise are essential, though today’s obsessive pursuit of fashionable thinness needs to be jettisoned; people before the petroleum age, when reserves of body fat played a vital role in survival, tended to be plumper than current fashions allow, and a return to 19th-century standards of normal weight is as necessary as it is inevitable. Those who learn and practice effective alternative health care methods will be at a distinct advantage, and may also find themselves with a marketable trade.

Still, in the absence of effective public health measures, even the best health care – alternative or otherwise – will have its limits. No medicine can take the place of adequate sanitation, pure water, clean and wholesome food, and the other foundations of public health so many of us take for granted nowadays. All these things will be in short supply in the deindustrial future, and so illness and death will be a constant and familiar presence. Learning to live with that reality will also be an essential skill in the twilight of the industrial age. We will no longer be able to afford the fantasy that death is something that only happens to other people – and in the process of coming to terms with our own mortality, we may just learn something essential about being human.

It’s not surprising that this particular crisis has gotten so little air time. Public health is one of the least regarded, though among the most necessary, of the basic services industrial society provides its citizens. It’s not exciting stuff. Sanitation, pest control, water treatment, food safety regulations, and the like are exactly the sort of humdrum bureaucratic activities that today’s popular culture ignores most readily. Even infectious disease control rarely achieves the level of intensity chronicled, say, in Randy Shilts’ history of the AIDS epidemic, And The Band Played On; more often it’s a matter of collecting statistics, tracing contacts, and sending emails to local officials and hospitals in the certain knowledge that most of the recipients will just hit the delete button. On these pedestrian activities, though, rests the industrial world’s relative freedom from the plagues that visited previous societies so regularly and killed so many of our ancestors.

The impending collapse of public health, like most aspects of our current predicament, has an abundance of causes. One is the failure of government at all levels to maintain even the very modest support public health once received. Lacking an influential constituency in the political class, public health departments far more often than not came out the losers in the tax and budget struggles that dominated American state and local politics in the last quarter of the 20th century. Worse, food safety regulations were among the consumer protections gutted by business-friendly politicians, with results that make the headlines tolerably often these days.

A second factor in collapsing public health is the end of the antibiotic age. Starting in the early years of the 20th century, when penicillin revolutionized the treatment of bacterial infections, antibiotics transformed medical practice. Dozens of once-lethal diseases – diphtheria, tuberculosis, bubonic plague, and many others – became treatable conditions. A few prescient researchers cautioned that microbes could evolve resistance to the new “wonder drugs” if the latter were used too indiscriminately, but their warnings went unheard amid the cheerleading of a pharmaceutical industry concerned only with increasing sales and profits, and a medical system that became little more than the pharmaceutical industry’s marketing arm. The result has been an explosion of antibiotic-resistant microbes. The media not long ago announced the emergence of XDR (extreme drug resistant) tuberculosis in Africa and Asia, adding to the list of microbes even the best modern antibiotics won’t treat.

A third and even more worrisome factor is the impact of ecological disruption on patterns of disease. As the number of people on an already overcrowded globe spirals upwards, more and more of the earth’s wild lands come under pressure, and microbes that have filled stable ecological niches since long before our species arrived on the scene end up coming into contact with new hosts and vectors. HIV, the virus that apparently causes AIDS, seems to have gotten into the human population that way; Ebola and a dozen other lethal hemorrhagic fevers certainly did, along with many others. At the same time, global warming driven by our smokestacks and tailpipes has changed distribution patterns of mosquitoes and other disease vectors, with the result that malaria, dengue fever, and other tropical diseases are starting to show up on the edges of today’s temperate zones.

Add the impact of fossil fuel depletion on these three factors and the results are unwelcome in the extreme. In a future of soaring energy costs and crumbling economies, public health is pretty much guaranteed less access to local government budgets than it has now, meaning that even the most basic public health services are likely to go by the boards. The same factors make it unlikely at best that pharmaceutical companies will be able to afford the expensive and resource-intensive process of developing new antibiotics that has kept physicians one step ahead of most of the antibiotic-resistant microbes so far. Finally, ecological disruption will only increase as a world population dependent on petroleum-based agriculture scrambles to survive the end of cheap oil, and the likelihood that many countries will switch to coal means that global warming will likely go into overdrive in the next few decades.

The inevitable result is the return of the health conditions of the 18th and 19th century, when deadly epidemics were routine events, childhood mortality was common, and most people could expect to die from infectious diseases rather than the chronic conditions that fill the “cause of death” slot on most death certificates these days. Factor in soaring rates of alcohol and drug abuse, violence, and malnutrition – all of them inevitable consequences of hard economic contraction – and you have a situation where the number of people on the planet will take a sharp downward turn. Statistics from Russia, where a similar scenario played out in the aftermath of the Soviet Union’s collapse, suggest that population levels could be halved in less than a century. This doesn’t require massive epidemics or the like; all it takes is a death rate from all causes well in excess of the birth rate, and that’s something we will certainly have as the deindustrial age begins.

The role of modern medicine in these transformations is complex. Especially in America, but not only there, economic forces long ago turned the theoretical triumphs of scientific medicine into a real-world fiasco. For well over a decade now, medical care has been the leading cause of death in the United States – add together the annual death toll from iatrogenic (physician-caused) diseases, nosocomial (hospital-transmitted) infections, drug side effects and interactions, risky but heavily advertised elective surgeries such as stomach stapling, and simple malpractice, and the resulting figure soars well above the annual toll for heart disease, or cancer, or anything else. As economic decline puts mainstream medical care out of reach of most people, death rates from these causes will drop correspondingly, and at least in the industrial world this may cushion the impact of the factors just discussed for a while.

Many people are already voting with their feet by abandoning conventional medicine for various alternative and traditional forms of medicine. Even when these don’t work – and of course some of them don’t – placebos are at least less likely to cause harm than the toxic drugs and invasive surgeries that form the mainstay of today’s conventional medicine. Many alternative health care systems, on the other hand, treat common illnesses quite effectively. Another factor, though, makes alternative methods much better suited to the coming deindustrial age than scientific medicine. Today’s medical system is among industrial civilization’s most voracious users of energy and natural resources; almost without exception, alternative medical treatments use much less of both. Many of the most effective alternative systems – herbalism and acupuncture come to mind – evolved long before the industrial system came into being and use very modest amounts of sustainable resources to treat illnesses. In an age of energy scarcity and hard ecological limits, systems like these are the wave of the future.

The tangled roots of the public health crisis make it a particular challenge to prepare for on an individual basis. Some things can certainly be done. A solid knowledge of first aid, nutrition, sanitation, and basic nursing procedures will go a long way. Sensible eating and healthy exercise are essential, though today’s obsessive pursuit of fashionable thinness needs to be jettisoned; people before the petroleum age, when reserves of body fat played a vital role in survival, tended to be plumper than current fashions allow, and a return to 19th-century standards of normal weight is as necessary as it is inevitable. Those who learn and practice effective alternative health care methods will be at a distinct advantage, and may also find themselves with a marketable trade.

Still, in the absence of effective public health measures, even the best health care – alternative or otherwise – will have its limits. No medicine can take the place of adequate sanitation, pure water, clean and wholesome food, and the other foundations of public health so many of us take for granted nowadays. All these things will be in short supply in the deindustrial future, and so illness and death will be a constant and familiar presence. Learning to live with that reality will also be an essential skill in the twilight of the industrial age. We will no longer be able to afford the fantasy that death is something that only happens to other people – and in the process of coming to terms with our own mortality, we may just learn something essential about being human.

Thursday, October 12, 2006

Economics: The Sound of Aunt Edna’s Knitting

If the economic landscape beyond Hubbert’s peak proves to be the sort of rough terrain outlined in my last two Archdruid Report posts, how can individuals, families, and communities deal with it? On the large scale, opportunities for action are limited at best, not least because the noise of volatility can too easily hide the signal of decline. Just as recent plunges in the price of oil and natural gas have encouraged the delusion that we no longer have to worry about energy, the upside of the post-peak economy – the fortunes made, the speculative gambles that pay off, the boomtimes when demand destruction crashes energy prices and all seems right with the world – will make it easy for people to convince themselves that industrial society is still on track.

It’s easy to understand this sort of thinking, since the alternative is to accept the unacceptable: to admit that the industrial age is ending, and the luxuries, conveniences, and standard of living that define ordinary lifestyles in the modern world are going away, not just for a little while, but forever. That the unacceptable is also inevitable makes it no easier to cope with. Still, accepting the unacceptable is the crucial step in dealing with the economic impact of peak oil. Every assumption about the future has to be reassessed in the light of a contracting economy in which money and other forms of abstract wealth no longer guarantee access to goods and services.

Not that long ago in historical terms, it's worth recalling, money actually played a fairly small role in the overall economic picture. Until well after 1700, more than half of all goods and services in the western world were produced and consumed in household and community economies, and exchanged in customary networks governed by obligation and reciprocity, not supply and demand. Most households produced the great majority of their own food, clothing, and other necessities, and used surpluses to barter for specialty goods with other local producers. Cash served as a means of exchange for things produced so far away that transport costs and spoilage made barter unworkable. It took cheap, abundant fossil fuel energy to make transportation so cheap that centralized production and distribution of commodities could take the place of local production for local use.

In the aftermath of peak oil, such local economies are the wave of the future, and the money economy of the present and recent past is an anachronism. Since fossil fuel depletion is a gradual process, though, the changeover won’t happen all at once. This is a good thing, since the vast majority of people in the industrial world today lack the skills and tools to function in a local economy. Their jobs – from executives and consultants through salespeople, office staff, and all the other cubicle-shaped pigeonholes in the corporate caste system – serve functions internal to the industrial economy instead of producing goods and services people want or need.

The jobs that matter in a deindustrial economy, by contrast, are the ones that meet human needs directly. Farming is the classic example. If you grow food crops with your own labor, you don’t actually need the money economy, except insofar as it forces itself on you by way of property taxes and the like. Your labor provides you with value directly, since some of your crops end up on your own kitchen table; the rest can be exchanged with other local sources of goods and services you need – the seamstress next door, the blacksmith down the road, the general store in town. Money is a convenient way of facilitating these exchanges, but it’s not necessary; you can as well use barter, or local scrip, or any other means of exchanging value that comes to hand. Because what you produce has value to other people, you can trade for the things other people produce that you need, whether or not the money economy is there to mediate the trade.

Compare the farmer to a corporate marketing assistant or a factory worker in an injection-casting plant and the differences become clear. The marketing assistant provides a service – helping to create and manage marketing plans for a corporation – that has no value outside the money economy. If she wanted to barter with a farmer for food, she probably wouldn’t get far offering to help manage his corporate identity via a media campaign! The factory worker is in a slightly better position. If the money economy comes unglued, the factory owners might pay him in castings, and he could then try to barter these for the goods and services he needs; exactly this arrangement was common in the former Soviet Union during the economic collapse of the early 1990s. Still, he depends on the factory and its owners to provide him with a workplace and some form of pay, and in a volatile, crumbling economy his situation is a precarious one.

In the deindustrial age, then, the farmer’s economic model is the more viable, because it can do without the mediation of the money economy. Other professions that produce necessary goods and services will be in the same comfortable position, since people will continue to need food, clothing, shoes, tools, and the like, and will trade for them using whatever means are available. Except in the most difficult times, they will also be willing to trade for other things that aren’t quite necessities; someone who brews good beer, for example, can count on a market for his wares in all but the most apocalyptic times, and quite possibly even then.

Since the twilight of the money economy will be a gradual process, it won’t necessarily be possible for individuals to make the transition to a deindustrial career in a single leap. What can and must be tackled right now is the learning curve demanded by any of these skilled trades. It’s not enough to line your shelves with books about organic farming, for example; you need to start buying tools, digging garden beds, and growing your own crops, and you need to do this as soon as possible, because mastering the craft of organic farming takes time. The same is true if you decide to take up blacksmithying, brewing, small appliance repair, or any other useful trade: you need to get the tools and start learning the craft, so you’ll have your Plan B firmly in place when the money economy folds out from under you.

Skilled trades for local exchange are part of the picture, but another part is just as essential – the reinvention of the household economy. Not so long ago, a large fraction of all economic value came from the household sector. Many of us still remember grandmothers who always had jars of homemade jelly in the cupboard and crochet hooks dancing in their hands, and grandfathers whose garages were as full of well-worn tools as their gardens were of ripe tomatoes. The marketing campaigns that squeezed the last traces of the household economy out of existence stigmatized these activities as hobbies, and dowdy hobbies at that, but they were once a good deal more – and in a world on the brink of deindustrialization, they desperately need to be revived.

People have different opportunities and talents, and one size emphatically does not fit all. For those who have access to garden space, though, a household garden is probably the top priority here. It’s not necessary to grow all your own food, or even a large proportion of your total calorie intake, for this to have a significant impact on your quality of life. In America, at least, bulk crops such as grains and beans will likely be available via the money economy for many years to come. Fruits, vegetables, and animal foods – that is, sources of vitamins, minerals, and protein – are another matter. A vegetable garden, a couple of fruit trees, and perhaps a rabbit hutch or a tank for carp or tilapia may mean the difference between malnutrition and health.

If you don’t have access to garden space, consider taking up a useful handicraft or two. Aunt Edna’s habit of knitting cardigans for all and sundry may have seemed quaint in the heyday of the industrial economy, but when central heating prices itself out of existence and transport costs put paid to clothing imports from Third World sweatshops, warm clothing you can make with your own hands has obvious value, and may also be a useful item of barter. The same is true of many other skills, from soapmaking and herbal medicine to the handyman skills that allow plumbing, furniture, and appliances to be repaired at home.

Another response to human wants and needs outside the money economy will be vital during the deindustrial age, and needs to be revived and practiced as soon as possible. This is the art of doing without. The industrial economy has trained all of us to think that the only possible thing to do with a desire is fulfill it, preferably by spending money on some consumer product or other. The contracting economy of the deindustrial age will offer very little leeway to this sort of self-indulgent thinking. On the far side of Hubbert’s peak, your capacity to survive will largely be measured by the number of things you can do without. It’s hardly an accident, either, that the world’s spiritual traditions also affirm the value of being unattached to material things.

Among the things we will have to learn to do without, though, perhaps the most important is not a material thing at all, but a habit – the deliberate cultivation of uselessness that goes by the name of “leisure.” Only a society flush with cheap energy could convince itself that the highest goal of human life is to sit around doing nothing, and even so it takes the nonstop blare of the media to distract us from the fact that sitting around doing nothing is the dullest of all human activities. Our grandparents’ generation and their ancestors knew as much, which is why leisure a century ago focused on creative activities rather than indolence, and why Aunt Edna knitted all those cardigans long after the industrial economy made home production of clothing unnecessary. The twilight of industrial society, like the fall of other civilizations before it, will doubtless be accompanied by plenty of tumult and shouting, but the real story – the signal behind all that noise – will be a much fainter sound: the soft clatter of Aunt Edna’s knitting needles, beginning to knit the fabric of a new and more sustainable world.

It’s easy to understand this sort of thinking, since the alternative is to accept the unacceptable: to admit that the industrial age is ending, and the luxuries, conveniences, and standard of living that define ordinary lifestyles in the modern world are going away, not just for a little while, but forever. That the unacceptable is also inevitable makes it no easier to cope with. Still, accepting the unacceptable is the crucial step in dealing with the economic impact of peak oil. Every assumption about the future has to be reassessed in the light of a contracting economy in which money and other forms of abstract wealth no longer guarantee access to goods and services.

Not that long ago in historical terms, it's worth recalling, money actually played a fairly small role in the overall economic picture. Until well after 1700, more than half of all goods and services in the western world were produced and consumed in household and community economies, and exchanged in customary networks governed by obligation and reciprocity, not supply and demand. Most households produced the great majority of their own food, clothing, and other necessities, and used surpluses to barter for specialty goods with other local producers. Cash served as a means of exchange for things produced so far away that transport costs and spoilage made barter unworkable. It took cheap, abundant fossil fuel energy to make transportation so cheap that centralized production and distribution of commodities could take the place of local production for local use.

In the aftermath of peak oil, such local economies are the wave of the future, and the money economy of the present and recent past is an anachronism. Since fossil fuel depletion is a gradual process, though, the changeover won’t happen all at once. This is a good thing, since the vast majority of people in the industrial world today lack the skills and tools to function in a local economy. Their jobs – from executives and consultants through salespeople, office staff, and all the other cubicle-shaped pigeonholes in the corporate caste system – serve functions internal to the industrial economy instead of producing goods and services people want or need.

The jobs that matter in a deindustrial economy, by contrast, are the ones that meet human needs directly. Farming is the classic example. If you grow food crops with your own labor, you don’t actually need the money economy, except insofar as it forces itself on you by way of property taxes and the like. Your labor provides you with value directly, since some of your crops end up on your own kitchen table; the rest can be exchanged with other local sources of goods and services you need – the seamstress next door, the blacksmith down the road, the general store in town. Money is a convenient way of facilitating these exchanges, but it’s not necessary; you can as well use barter, or local scrip, or any other means of exchanging value that comes to hand. Because what you produce has value to other people, you can trade for the things other people produce that you need, whether or not the money economy is there to mediate the trade.

Compare the farmer to a corporate marketing assistant or a factory worker in an injection-casting plant and the differences become clear. The marketing assistant provides a service – helping to create and manage marketing plans for a corporation – that has no value outside the money economy. If she wanted to barter with a farmer for food, she probably wouldn’t get far offering to help manage his corporate identity via a media campaign! The factory worker is in a slightly better position. If the money economy comes unglued, the factory owners might pay him in castings, and he could then try to barter these for the goods and services he needs; exactly this arrangement was common in the former Soviet Union during the economic collapse of the early 1990s. Still, he depends on the factory and its owners to provide him with a workplace and some form of pay, and in a volatile, crumbling economy his situation is a precarious one.

In the deindustrial age, then, the farmer’s economic model is the more viable, because it can do without the mediation of the money economy. Other professions that produce necessary goods and services will be in the same comfortable position, since people will continue to need food, clothing, shoes, tools, and the like, and will trade for them using whatever means are available. Except in the most difficult times, they will also be willing to trade for other things that aren’t quite necessities; someone who brews good beer, for example, can count on a market for his wares in all but the most apocalyptic times, and quite possibly even then.

Since the twilight of the money economy will be a gradual process, it won’t necessarily be possible for individuals to make the transition to a deindustrial career in a single leap. What can and must be tackled right now is the learning curve demanded by any of these skilled trades. It’s not enough to line your shelves with books about organic farming, for example; you need to start buying tools, digging garden beds, and growing your own crops, and you need to do this as soon as possible, because mastering the craft of organic farming takes time. The same is true if you decide to take up blacksmithying, brewing, small appliance repair, or any other useful trade: you need to get the tools and start learning the craft, so you’ll have your Plan B firmly in place when the money economy folds out from under you.

Skilled trades for local exchange are part of the picture, but another part is just as essential – the reinvention of the household economy. Not so long ago, a large fraction of all economic value came from the household sector. Many of us still remember grandmothers who always had jars of homemade jelly in the cupboard and crochet hooks dancing in their hands, and grandfathers whose garages were as full of well-worn tools as their gardens were of ripe tomatoes. The marketing campaigns that squeezed the last traces of the household economy out of existence stigmatized these activities as hobbies, and dowdy hobbies at that, but they were once a good deal more – and in a world on the brink of deindustrialization, they desperately need to be revived.

People have different opportunities and talents, and one size emphatically does not fit all. For those who have access to garden space, though, a household garden is probably the top priority here. It’s not necessary to grow all your own food, or even a large proportion of your total calorie intake, for this to have a significant impact on your quality of life. In America, at least, bulk crops such as grains and beans will likely be available via the money economy for many years to come. Fruits, vegetables, and animal foods – that is, sources of vitamins, minerals, and protein – are another matter. A vegetable garden, a couple of fruit trees, and perhaps a rabbit hutch or a tank for carp or tilapia may mean the difference between malnutrition and health.

If you don’t have access to garden space, consider taking up a useful handicraft or two. Aunt Edna’s habit of knitting cardigans for all and sundry may have seemed quaint in the heyday of the industrial economy, but when central heating prices itself out of existence and transport costs put paid to clothing imports from Third World sweatshops, warm clothing you can make with your own hands has obvious value, and may also be a useful item of barter. The same is true of many other skills, from soapmaking and herbal medicine to the handyman skills that allow plumbing, furniture, and appliances to be repaired at home.

Another response to human wants and needs outside the money economy will be vital during the deindustrial age, and needs to be revived and practiced as soon as possible. This is the art of doing without. The industrial economy has trained all of us to think that the only possible thing to do with a desire is fulfill it, preferably by spending money on some consumer product or other. The contracting economy of the deindustrial age will offer very little leeway to this sort of self-indulgent thinking. On the far side of Hubbert’s peak, your capacity to survive will largely be measured by the number of things you can do without. It’s hardly an accident, either, that the world’s spiritual traditions also affirm the value of being unattached to material things.

Among the things we will have to learn to do without, though, perhaps the most important is not a material thing at all, but a habit – the deliberate cultivation of uselessness that goes by the name of “leisure.” Only a society flush with cheap energy could convince itself that the highest goal of human life is to sit around doing nothing, and even so it takes the nonstop blare of the media to distract us from the fact that sitting around doing nothing is the dullest of all human activities. Our grandparents’ generation and their ancestors knew as much, which is why leisure a century ago focused on creative activities rather than indolence, and why Aunt Edna knitted all those cardigans long after the industrial economy made home production of clothing unnecessary. The twilight of industrial society, like the fall of other civilizations before it, will doubtless be accompanied by plenty of tumult and shouting, but the real story – the signal behind all that noise – will be a much fainter sound: the soft clatter of Aunt Edna’s knitting needles, beginning to knit the fabric of a new and more sustainable world.

Thursday, October 05, 2006

Economics: Hallucinated Wealth

As last week’s Archdruid Report post argued, prophecies of catastrophe don’t accurately reflect the economic terrain on the downslope of Hubbert’s peak. Mind you, the reassuring fictions of those who insist that business as usual will go on forever won’t fare any better. I’ve suggested that the future we face is an age of economic, social, and technological decline as industrial civilization slides down the long and bumpy slope to the agrarian societies of the deindustrial future. The economic dimension of that decline is crucial, but those who expect it to show up in obvious ways in the markets and crunched numbers of today’s official economics may be missing a central facet of what’s going on.

I have no idea if kids still do this, but in my elementary school days in the late 1960s it was common practice to write IOUs for “a million billion trillion dollars” or some equally precise sum, and use those as the stakes in card games like Old Maid and Go Fish. Some of those IOUs passed from hand to hand dozens of times before being accidentally left in a pocket and meeting their fate in the wash. Kids who were good card players amassed portfolios with a very impressive face value, especially compared to the 25 cents a week that was the standard allowance in my neighborhood just then. If I recall correctly, though, nobody ever tried to convert their IOU holdings into anything more substantial than cookies from a classmate’s lunchbox, and that’s apparently the one thing that kept me and my friends from becoming pioneers of modern finance.

It surprises me how many people still seem to think that the main business of a modern economy is the production and distribution of goods and services. In point of fact, far and away the majority of economic activity today consists of the production and exchange of IOUs. The United States has the world’s largest economy not because it produces more goods and services than anyone else – it doesn’t, not by a long shot – but because it produces more IOUs than anyone else, and sells those IOUs to the rest of the world in exchange for goods and services.

An IOU, after all, is simply a promise to pay a given amount of value at some future time. That describes nearly every instrument of exchange in today’s economy, from bonds and treasury bills through bank deposits and government-issued currency to credit swaps and derivatives. All these share three things in common with the IOUs my schoolmates staked on card games. First, they cost almost nothing to issue. Second, their face value needn’t have any relationship at all to the issuer’s ability to pay up. Third, they can be exchanged for goods and services – like the cookies in my example – but their main role is in exchanges where nothing passes from hand to hand except IOUs.

It’s harsh but not, I think, unfair to call the result an economy of hallucinated wealth. Like the face value of those schoolroom IOUs, most “wealth” nowadays exists only because everyone agrees it does. Outside the social game of the market economy, financial instruments have no value at all, and the game continues only because the players – all of them, from the very rich to the ones with scarcely a million billion trillion dollars to their name – keep playing. They have to keep playing, because access to goods and services, not to mention privilege, perks, and power, depend on participation in the game.

The resulting IOU economy is highly unstable, because hallucinated wealth has value only as long as people believe it does. The history of modern economics is thus a chronicle of booms and busts, as tidal shifts in opinion send various classes of IOUs zooming up in value and then crashing back down to earth. Crashes, far from being signs of breakdown, are a necessary and normal part of the process. They serve the same role as laundry day did in the schoolroom IOU economy, paring down the total number of IOUs when an excess emerges, and thus maintaining the fiction that the ones left still have value.

All this leaves us in a historically unprecedented situation. Economies based purely on hallucinated wealth existed before the 20th century, but only for brief periods in the midst of speculative frenzies – the Dutch tulip mania, the South Sea bubble, and so on. Today’s hallucinated wealth, by contrast, has maintained its place as the mainspring of the global economy for more than half a century. Social critics who point to the housing bubble, the derivatives bubble, or the like, and predict imminent disaster when these bubbles pop, are missing the wider picture: the great majority of the global economy rests on the same foundations of empty air.

Those who have noticed this wider picture, on the other hand, are fond of suggesting that sometime soon, given a suitable shock, the entire structure will come cascading down. Those of you who were reading the alternative press at the time of the 1987 stock market crash will recall predictions of economic collapse in the wake of that vertiginous plunge. Similar predictions have accompanied each of the notable fiscal crises since then – the Japanese stock market debacle of 1990, the Mexican debt crisis of 1995, the Asian currency crash of 1998, the tech-stock crash of 2000, and so on. Similar claims are now being made about the housing bubble, the US trade and credit deficit, and of course about peak oil as well.

Plausible as these claims are, I suspect they’re missing the core of the situation, as well as the lessons taught by twenty years of violent economic gyrations. It’s a mistake to expect hallucinations to obey the laws of gravity. It’s doubly a mistake when the institutions charged with keeping them in midair – the Federal Reserve Board in the US and its equivalents elsewhere – have proven tolerably adept at manipulating markets, flooding the economy with cheap credit (that is, more IOUs) to minimize the effects of a crash, and inflating some other sector of the economy to take up the slack of a deflating bubble. It’s triply a mistake when the American middle class and, to a lesser extent, its equivalents in other industrial countries display a faith in speculation so invulnerable to mere reality that their response to a crash in one market is invariably to go looking for a new speculative bubble somewhere else.

To say that the economic empire of hallucinated wealth will continue to exist, though, does not imply that it will continue to produce the goods and services and provide the jobs that people need. Arguably, it doesn’t do that very well now. The “jobless recovery” of recent years saw most economic statistics rise well into positive territory, while most people saw their expenses rise and their income shrink when their jobs didn’t simply fold out from under them. Things could go much further in the same direction. It requires no particular suspension of disbelief to imagine a situation where the stock market hits new heights daily and other measures of economic activity remain in positive territory, while most of the population is starving in the streets.

Partly, as Bernard Gross pointed out several decades ago, economic indicators have morphed into “economic vindicators” that promote a political agenda rather than reflecting economic realities. The dubious statistical gamesmanship inflicted on the consumer price index and the official unemployment rate in the US show this with a good deal of clarity. Partly, though, most of the common measures of economic well-being only track hallucinated wealth, and the markets whose antics fill so much of the financial news are IOU markets disconnected from what remains of the real economy, where real people produce and consume real goods and services.

Thus trying to track the economic impact of peak oil, global warming, and other aspects of our predicament by watching markets and financial statistics may well turn out to be as misleading as trying to track the supply of cookies in a schoolroom by watching the exchange of IOUs in card games. As for the theory that a massive market crash triggered by peak oil will bring down the economy, this is, to be frank, naive. Crashes there will certainly be, and some of them may be monumental, since volatility in the energy markets tends to play crack-the-whip with the rest of the economy. Crashes aren’t threats to the system, though; crashes, and the recessions and economic turmoil that follow them, are part of the system.

The economy of markets and statistics has aptly been compared to a circus, and like any other circus, it serves mostly to distract. While interest rates wow the crowd with their high-wire act and clowns pile into and out of various speculative vehicles, the real story of economic decline will be going on elsewhere, in the non-hallucinated economy of goods and services, jobs and personal income, all but invisible behind a veil of massaged numbers and discreetly unmentioned by the mainstream media. There's good reason for that to be tucked out of sight, too, because it won't be pretty at all.

As the boom and bust cycle continues and accelerates, we can expect each recession to push more people down into poverty, and each recovery to lift fewer out of it. As industries dependent on cheap abundant energy fold, we’ll see jobs evaporate, lines form at the doors of soup kitchens, and today's posh suburbs slump into tomorrow’s shantytowns. Rising transport costs and sinking median incomes will squeeze the global trade in consumer goods until it implodes; shortages and ad hoc distribution networks will be the order of the day, and wild gyrations in currency markets could easily make barter and local scrip worth a good deal more than a million billion trillion dollars of hyperinflated IOU-money. Poverty, malnutrition, and desperation will be among the very few things not in short supply.

It’s not a pretty future, no, but there are straightforward ways to cope with it, proven in equivalent economic crises in recent history. I’ll be discussing some of those in next week’s post.

I have no idea if kids still do this, but in my elementary school days in the late 1960s it was common practice to write IOUs for “a million billion trillion dollars” or some equally precise sum, and use those as the stakes in card games like Old Maid and Go Fish. Some of those IOUs passed from hand to hand dozens of times before being accidentally left in a pocket and meeting their fate in the wash. Kids who were good card players amassed portfolios with a very impressive face value, especially compared to the 25 cents a week that was the standard allowance in my neighborhood just then. If I recall correctly, though, nobody ever tried to convert their IOU holdings into anything more substantial than cookies from a classmate’s lunchbox, and that’s apparently the one thing that kept me and my friends from becoming pioneers of modern finance.

It surprises me how many people still seem to think that the main business of a modern economy is the production and distribution of goods and services. In point of fact, far and away the majority of economic activity today consists of the production and exchange of IOUs. The United States has the world’s largest economy not because it produces more goods and services than anyone else – it doesn’t, not by a long shot – but because it produces more IOUs than anyone else, and sells those IOUs to the rest of the world in exchange for goods and services.

An IOU, after all, is simply a promise to pay a given amount of value at some future time. That describes nearly every instrument of exchange in today’s economy, from bonds and treasury bills through bank deposits and government-issued currency to credit swaps and derivatives. All these share three things in common with the IOUs my schoolmates staked on card games. First, they cost almost nothing to issue. Second, their face value needn’t have any relationship at all to the issuer’s ability to pay up. Third, they can be exchanged for goods and services – like the cookies in my example – but their main role is in exchanges where nothing passes from hand to hand except IOUs.

It’s harsh but not, I think, unfair to call the result an economy of hallucinated wealth. Like the face value of those schoolroom IOUs, most “wealth” nowadays exists only because everyone agrees it does. Outside the social game of the market economy, financial instruments have no value at all, and the game continues only because the players – all of them, from the very rich to the ones with scarcely a million billion trillion dollars to their name – keep playing. They have to keep playing, because access to goods and services, not to mention privilege, perks, and power, depend on participation in the game.

The resulting IOU economy is highly unstable, because hallucinated wealth has value only as long as people believe it does. The history of modern economics is thus a chronicle of booms and busts, as tidal shifts in opinion send various classes of IOUs zooming up in value and then crashing back down to earth. Crashes, far from being signs of breakdown, are a necessary and normal part of the process. They serve the same role as laundry day did in the schoolroom IOU economy, paring down the total number of IOUs when an excess emerges, and thus maintaining the fiction that the ones left still have value.

All this leaves us in a historically unprecedented situation. Economies based purely on hallucinated wealth existed before the 20th century, but only for brief periods in the midst of speculative frenzies – the Dutch tulip mania, the South Sea bubble, and so on. Today’s hallucinated wealth, by contrast, has maintained its place as the mainspring of the global economy for more than half a century. Social critics who point to the housing bubble, the derivatives bubble, or the like, and predict imminent disaster when these bubbles pop, are missing the wider picture: the great majority of the global economy rests on the same foundations of empty air.

Those who have noticed this wider picture, on the other hand, are fond of suggesting that sometime soon, given a suitable shock, the entire structure will come cascading down. Those of you who were reading the alternative press at the time of the 1987 stock market crash will recall predictions of economic collapse in the wake of that vertiginous plunge. Similar predictions have accompanied each of the notable fiscal crises since then – the Japanese stock market debacle of 1990, the Mexican debt crisis of 1995, the Asian currency crash of 1998, the tech-stock crash of 2000, and so on. Similar claims are now being made about the housing bubble, the US trade and credit deficit, and of course about peak oil as well.

Plausible as these claims are, I suspect they’re missing the core of the situation, as well as the lessons taught by twenty years of violent economic gyrations. It’s a mistake to expect hallucinations to obey the laws of gravity. It’s doubly a mistake when the institutions charged with keeping them in midair – the Federal Reserve Board in the US and its equivalents elsewhere – have proven tolerably adept at manipulating markets, flooding the economy with cheap credit (that is, more IOUs) to minimize the effects of a crash, and inflating some other sector of the economy to take up the slack of a deflating bubble. It’s triply a mistake when the American middle class and, to a lesser extent, its equivalents in other industrial countries display a faith in speculation so invulnerable to mere reality that their response to a crash in one market is invariably to go looking for a new speculative bubble somewhere else.

To say that the economic empire of hallucinated wealth will continue to exist, though, does not imply that it will continue to produce the goods and services and provide the jobs that people need. Arguably, it doesn’t do that very well now. The “jobless recovery” of recent years saw most economic statistics rise well into positive territory, while most people saw their expenses rise and their income shrink when their jobs didn’t simply fold out from under them. Things could go much further in the same direction. It requires no particular suspension of disbelief to imagine a situation where the stock market hits new heights daily and other measures of economic activity remain in positive territory, while most of the population is starving in the streets.

Partly, as Bernard Gross pointed out several decades ago, economic indicators have morphed into “economic vindicators” that promote a political agenda rather than reflecting economic realities. The dubious statistical gamesmanship inflicted on the consumer price index and the official unemployment rate in the US show this with a good deal of clarity. Partly, though, most of the common measures of economic well-being only track hallucinated wealth, and the markets whose antics fill so much of the financial news are IOU markets disconnected from what remains of the real economy, where real people produce and consume real goods and services.

Thus trying to track the economic impact of peak oil, global warming, and other aspects of our predicament by watching markets and financial statistics may well turn out to be as misleading as trying to track the supply of cookies in a schoolroom by watching the exchange of IOUs in card games. As for the theory that a massive market crash triggered by peak oil will bring down the economy, this is, to be frank, naive. Crashes there will certainly be, and some of them may be monumental, since volatility in the energy markets tends to play crack-the-whip with the rest of the economy. Crashes aren’t threats to the system, though; crashes, and the recessions and economic turmoil that follow them, are part of the system.

The economy of markets and statistics has aptly been compared to a circus, and like any other circus, it serves mostly to distract. While interest rates wow the crowd with their high-wire act and clowns pile into and out of various speculative vehicles, the real story of economic decline will be going on elsewhere, in the non-hallucinated economy of goods and services, jobs and personal income, all but invisible behind a veil of massaged numbers and discreetly unmentioned by the mainstream media. There's good reason for that to be tucked out of sight, too, because it won't be pretty at all.

As the boom and bust cycle continues and accelerates, we can expect each recession to push more people down into poverty, and each recovery to lift fewer out of it. As industries dependent on cheap abundant energy fold, we’ll see jobs evaporate, lines form at the doors of soup kitchens, and today's posh suburbs slump into tomorrow’s shantytowns. Rising transport costs and sinking median incomes will squeeze the global trade in consumer goods until it implodes; shortages and ad hoc distribution networks will be the order of the day, and wild gyrations in currency markets could easily make barter and local scrip worth a good deal more than a million billion trillion dollars of hyperinflated IOU-money. Poverty, malnutrition, and desperation will be among the very few things not in short supply.

It’s not a pretty future, no, but there are straightforward ways to cope with it, proven in equivalent economic crises in recent history. I’ll be discussing some of those in next week’s post.