It’s a bit ironic, given the events now in the headlines, that I started last week’s post by commenting that it had been an interesting week for connoisseurs of decline and fall; it might have been better to say “You ain’t seen nothing yet.” About the time the volcanic ash from Iceland began settling out of Europe’s airspace, to begin with, another black cloud began to rise from the lava vents of Wall Street, caused by the spontaneous combustion of whatever might have been left of Goldman Sachs’ reputation for fiscal probity.

It’s a fascinating turn of events, not least because Goldman Sachs has been remarkably cozy with the last two presidential administrations here in the US. Still, that didn’t keep the SEC from filing fraud charges against the firm, and it didn’t prevent the publication of a flurry of highly damaging emails in which Goldman Sachs executives boasted about selling made-to-fail securities to widows and orphans – yes, that last phrase actually got used – and then taking out short contracts on those same securities, so that Goldman Sachs profited when the securities did what they were designed to do, and lost money. For all the world like Casablanca’s Captain Renault, Congress is shocked, shocked to find that Goldman Sachs is making money at its customers’ expense; the interesting question is whether this fine imitation of outrage is simply the sort of ritual theater governments use so often these days as a substitute for constructive action, or whether serious power shifts are under way.

My guess, for what it’s worth, is the latter. Despite cheerleading and doctored statistics from within the Beltway, the US economy is in deep and deepening trouble; foreclosures continue to climb, commercial real estate and second mortgages are shaping up to be the next big shocks, and the rolling collapse of state and local government finances shows no sign of slowing down. The Goldman Sachs flacks who moved into power with the Obama administration promised to fix things; they have pretty clearly failed; and as the neoconservatives learned not long ago, intolerance for failure is very nearly the only thing on which the squabbling factions of the American political class can agree.

Meanwhile, another plume of smoke has been rising from Europe. Greece has had its credit rating cut to junk-bond levels; Portugal and Spain have suffered downgrades, and even rock-solid Germany has had trouble selling its bonds, as investors price in the economic burdens of bailing out countries that lack the political will to keep their expenditures in line with their national income. If the response to this crisis is bungled badly enough, it’s not impossible that the survival of the Euro may be at risk; it’s still open to question whether a single currency will work without a single government to back and manage it, and the handwaving and bickering that has been the order of business in European capitals as the crisis has unfolded does not particularly inspire confidence.

Speaking of plumes of smoke, of course, calls to mind the third unfolding disaster of the last week, the wreck of the Deepwater Horizon drilling rig, which according to an announcement today is currently spewing around five thousand barrels of oil a day into the Gulf of Mexico. The US Coast Guard has announced that it plans to light the spreading oil slick on fire, in the hope that enough of it will burn up to save the $2 billion a year Louisiana seafood industry from disaster. Partisans of the “drill, baby, drill” approach to energy security take note: there are good practical and economic reasons why most of the US coast has long been off limits to oil drilling, and getting oil out of deposits nearly a mile underwater, and a good deal further than that under sea-bottom sediments, is not as foolproof a procedure as politicians and talk show hosts would like you to think.

These three smoke plumes, interestingly enough, have a factor in common, and it’s the theme I want to discuss in this week’s post – not least because a great many of the crises we’re likely to face as the age of cheap abundant energy comes to an end also share that factor. All three of them resulted when people in a situation of high complexity tried to solve the problems of that situation by adding on an additional layer of complexity.

Goldman Sachs, to begin with, has been in the business of making complex problems more complex for a very long time. One of the chapters of John Kenneth Galbraith’s excellent The Great Crash 1929, a book which ought to be required reading for all those people who think they understand the stock market, is titled “In Goldman, Sachs We Trust”; it’s an account of the preposterous investment vehicles – it does violence to the English language to call them “securities” – that Goldman Sachs floated in the 1929 stock market bubble. Very little has changed since then, either. In 1929, Goldman Sachs sold shares of investment trusts that speculated in shares of other investment trusts; in 2009, they sold tranches of CDOs composed of tranches of other CDOs, and in both cases they served mostly as a means by which a lot of people lost a lot of money while Goldman Sachs did quite well.

You may be wondering why anybody would put their hard-earned money into an investment vehicle that consisted of a collection of bets that other investment vehicles would make money off yet a third set of investment vehicles. In 1929, the answer was raw greed, whipped up to monumental intensity by a very widespread attack of the delusion that brokers want to make you rich. In 2009, the answer was more complex. For more than twenty years, beginning in the wake of the 1987 Wall Street crash, the financial agencies of the US government had been struggling to keep what was left of the American economy from imploding. One of the main tools used in this struggle was rock-bottom interest rates, which were brought into play whenever one speculative bubble popped and which then, with clockwork regularity, fed the new speculative bubble that followed.

One of the many problems set in motion by this strategy was that all the ordinary sources of investment income were reduced to paying chump change. Gone were the halcyon days when every bank in the United States paid 5.25% per annum on savings accounts by federal law. (It somehow seems to have escaped the attention of most economic historians that the end of that era coincided very precisely with the point at which most Americans stopped putting their money into savings accounts.) As the Fed repeatedly bounced interest rates off the floor to jumpstart an increasingly reluctant economy, every person and institution dependent on investment income found themselves facing a sharp decrease in income. The simple solution would have been to accept the austerity that this entailed, but for obvious reasons this was not popular; it’s worth remembering that “simple” is rarely the same thing as “easy.”

The alternative was to respond to this complex set of circumstances by adding another layer of complexity, and Goldman Sachs was ready to help them do so. Complicated, risky investment strategies that promised high returns became the order of the day. In their eagerness to make more than chump change, a great many people thus became chumps.

The situation in Greece, and a great many other southern European countries, was similar. The same habits of economic manipulation that made the US economy so complex over the last two decades were just as popular in Europe, with the added complexity of a single currency far too rigidly structured to deal with the economic vagaries of more than a dozen fractious nation-states with different economic policies. Add in the speculative boom in real estate that went bust in 2008, which flooded southern Europe with money and then took it all back with interest, and you have a very complex situation, one in which all the usual options were foreclosed by EU economic policy. There were several simple solutions, such as ditching the Euro and allowing a new Greek currency to find its market value, but once again, “simple” is not the same thing as “easy.”

The government of Greece responded to these complexities instead by adding another layer of complexity. It hired Goldman Sachs – no, I’m not making this up – to create a set of complicated investment vehicles that made the Greek national debt look smaller than it was, in order to get by the more onerous limits of EU economic policy. These vehicles proceeded to crash and burn in the grand style, and took the Greek economy with them. Similar vehicles were sold by quite a number of brokerages – Goldman Sachs was far from the only player here – to national, provincial, and municipal governments all over Europe, and to state and local governments in the US as well, and yes, they’ve been blowing up right and left; I don’t think vehicles so flammable have been seen in such numbers since the Ford Pinto was recalled.

As far as I know, Goldman Sachs had nothing to do with the Deepwater Horizon drilling platform. Still, the entire strategy of pursuing petroleum production in deep waters is an attempt to solve a hideously complex problem – the problem of peak oil – by adding on another layer of complexity. There’s a simple response to peak oil, of course; it consists of using less petroleum, making do with less energy per capita, and learning to live within our means. Once again, though, “simple” doesn’t mean “easy,” any more than it means “enjoyable” or “politically acceptable.”

The result is that we’re pursuing oil wherever we can find it, no matter how complex or risky the prospect might be. Deepwater drilling is one example. It’s complicated stuff, far more expensive and demanding than the methods used to extract oil that happens to be conveniently located under dry land, and when the standard problems faced by oilmen everywhere crop up, responding to those problems involves a whole new world of complexity and risk. One of those standard problems is the risk of a blowout: a sudden surge of crude oil and natural gas that can come bursting up through a well at any point between the moment it’s first drilled and the moment the relatively sturdy structure that handles production is in place.

That’s almost certainly what happened to Deepwater Horizon. It’s a common enough event in drilling for oil, and it’s dangerous even when it happens on dry land and there’s someplace for the drilling crew to run. When the well begins almost a mile underwater, though, there’s the additional problem that nobody has the tools to handle a deepwater blowout if the underwater valves meant to shut it off at the wellhead should fail. That’s also happened to Deepwater Horizon, and if the current efforts to trigger the valves via robot submersibles don’t succeed – and they’ve shown no sign of succeeding so far – the only option left to the BP response crews is to jerry-rig techniques designed for shallow waters and hope they can be made to work 5000 feet under the sea. In the meantime, five thousand barrels a day of crude oil fountain out into the Gulf from the crumpled pipe.

In all three of these cases, the decision to add an additional layer of complexity to an already complex problem was an attempt to maintain business as usual, while the simpler option that was refused would have required the decision makers to abandon business as usual and accept a degree of austerity and limitation very few people find congenial these days. That’s not inherent in the relationship between complexity and simplicity, but it does tend to be a very common feature of the way that relationship works out in practice just now. We have an extraordinarily complex society; for some three centuries, attempts to manage problems by increasing complexity have paid off more often than not, which is why we have such a complex society; and this has led to the kind of superstition discussed in last week’s post – the unthinking assumption that what worked in the past will continue to work in the present and the future.

As Joseph Tainter has pointed out in his useful book The Collapse of Complex Societies, though, increases in complexity are subject to the same law of diminishing returns as anything else, and sooner or later a society that responds to every challenge by adding a new layer of complexity will reach the point that adding more complexity causes more problems than it solves. Several observations concerning Tainter’s insight are worth making here.

First, the diminishing returns of complexity apply to specifics as well as generalities, and for statistical reasons, the specifics will usually show up first. A society that has overloaded itself with complexity will tend to heap up more complexity in some areas of life than others, and one or more of these areas may well tip over into dysfunction sooner than others. Thus a society that is hammered by repeated crises of the same kind, and tries to solve them with layers of additional complexity that consistently seem to make the problem worse, may be at risk of tipping over into a wider dysfunction of which the visible crises are merely symptomatic.

Second, if a society has driven itself past the point of negative returns on complexity, and continues to try to add complexity to solve the resulting problems, it risks establishing a disastrous feedback loop in which its attempts to solve its problems become the major source of its problems. This can also apply to specifics as well as generalities, and show up first in particular aspects of a society’s collective life.

Third, one of the ironies faced by a society that has reached the point of negative returns on complexity as a means of problem-solving is that thereafter, the only way it can solve its problems is by not solving its problems. Any attempt to impose additional complexity will simply make matters worse, while allowing some particularly problematic heap of complexity to crash and burn may just reduce the complexity of the whole system to a point at which something constructive can actually be done. In the extreme case, where an entire society has pushed itself past the point of negative returns on complexity, collapse can be an adaptive response to a rising spiral of crisis that can be ended in no other way.

Finally, all these considerations apply just as much to the level of the individual, family, and community as they do to civilizations as whole systems, and it’s possible to use simplification on the level of the individual, family, and community to counter at least some of the consequences of complexity run amok. We’ll talk more about how that might work next week.

Wednesday, April 28, 2010

Wednesday, April 21, 2010

Economic Superstitions

It has been an interesting week for connoisseurs of decline and fall. As I’m sure all my readers are aware by now, a small volcano in Iceland managed to chuck a sizable monkey wrench into the gears of business as usual across Europe by filling the upper atmosphere with a massive plume of what amounts to finely ground glass: just the thing you want to put into the intake of your favorite jet engine.

Most volcanic eruptions don’t do this, but Eyjafjallajokull – say that three times very fast – happens to be under a glacier. (It is located in a country called Iceland, after all.) Or, rather, it used to be under a glacier; bring molten lava into contact with a glacier and you don’t have a glacier for long. What you have instead is what volcanologists call a phreatic eruption and the rest of us call a steam explosion. Rinse (with lava) and repeat, and you get two things. The first is a stratosphere full of fine sandpaper grit; the second is most of a continent flailing helplessly as one of its transportation networks shuts down for several days.

The human reaction was instructive. One of my regular readers commented that his wife, who works in the travel industry, has been deluged by calls from irate travelers who seem convinced that she can make the ash go away with a couple of phone calls. An EU commissioner was caught in public saying that long distance tourism was an inalienable human right, while airlines demanded that governments compensate them for the closure of the skies; at least they had the grace not to demand the money from Iceland. Meanwhile Great Britain, which gets most of its fruit and much of its vegetables from the Third World by air, was facing the prospect of bare shelves in the grocery stores for the first time since the aftermath of the Second World War.

It’s been a while since we’ve had so clear a reminder that the intricate and fragile clockwork of industrial society depends so completely on Nature’s whims, but as usual, most people managed not to get the memo. Me, I didn’t give it much thought, since I was reading a different and more familiar memo, the one brought every spring by lengthening days and the waning risk of frost. I was out in the garden planting bush beans, dwarf peas, and Danvers carrots, since the weather was warm and the Moon was in a fertile sign.

Yes, I plant by the signs. I originally learned that habit out in the Pacific Northwest, where very few people do it, and it’s ironic that I ended up moving to the Appalachians, where most gardeners keep an eye on the almanac when choosing planting dates. Do I think it works? A lot depends on what’s meant by that rather facile question. It certainly doesn’t do any harm; my gardens get good results at least as reliably as those of my neighbors, and it’s no particular inconvenience to check the signs when deciding when to plant the next round of seeds. I don’t know for a fact that it helps, but then the same thing could be said for many other things I do in the garden. (I’m more interesting in growing vegetables than in proving a point, so I don’t deprive part of my garden of compost, say, to find out whether putting my kitchen wastes in the compost bin rather than a landfill makes as much difference as it seems.) Besides, planting by the signs has entertainment value: I’ve come to enjoy the theatrics the habit attracts from rationalists who get incensed by anything they consider superstitious.

Of course they’re quite correct that planting by the signs is a superstition, but that word has a subtler meaning than most people remember these days. A superstition is literally something “standing over” (in Latin, super stitio) from a previous age; more precisely, it’s an observance that has become detached from its meaning over time. A great many of today’s superstitions thus descend from the religious observances of archaic faiths. When my wife’s Welsh grandmother set a dish of milk outside the back door for luck, for example, she likely had no idea that her pagan ancestors did the same thing as an offering to the local tutelary spirits.

Yet there’s often a remarkable substrate of ecological common sense interwoven with such rites. If your livelihood depends on the fields around your hut, for example, and rodents are among the major threats you face, a ritual that will attract cats and other small predators to the vicinity of your back door night after night is not exactly foolish. The Japanese country folk who consider foxes the messengers of Inari the rice god, and put out offerings of fried tofu to attract them, are mixing agricultural ecology with folk religion in exactly the same way.

There’s a lot of this sort of thing in the world of superstition. I have long since lost the reference, but many years ago I read an ecological study of human hunting practices, which pointed out that nearly all cultures that get much of their food from the hunt use divination to decide where to hunt on any given day. The authors pointed out that according to game theory, the best strategy in any competition has to include a random element in order to keep the other side guessing. Most prey animals are quite clever enough to figure out a nonrandom pattern of hunting – there’s a reason why deer across America head into suburbs and towns, where hunting isn’t allowed, as soon as hunting season opens each year – so inserting a random factor into hunting strategy will pay off in increased kills over time. As far as we know, humans are the only animals that make decisions with the aid of horoscopes, tarot cards, yarrow stalks and the like, and it’s intriguing to think that this habit may have had a significant role in our evolutionary success.

Is this all there is to the practice of superstition? It’s a good question, and one that’s effectively impossible to answer. For all I know, all those ancient civilizations that built vast piles of stone to the honor of their gods may have been right to say that Marduk, Osiris, Kukulcan et al. were well pleased by having big temples erected in their honor, and reciprocated by granting peace and prosperity to their worshippers. It may just be a coincidence that channeling the boisterous energy of young men into some channel more constructive than civil war is a significant social problem in most civilizations, and giving them big blocks of stone to haul around in teams, in hot competition with other teams, seems to do the trick; it may also be a coincidence that convincing the very rich to spend their wealth employing huge numbers of laborers on vanity buildings provides a steady boost to even the simplest urban economy. Maybe this is how Kukulcan shows that he’s well pleased.

Still, there’s a wild card in the deck, because it’s possible for even the most useful superstition to become a major source of problems when conditions change. When the Mayan civilization overshot the carrying capacity of its fragile environment, the Mayan elite responded to the rising spiral of crisis by building more and bigger temples. That had worked in the past, but it failed to work this time, because the situation was different; the problem had stopped being one of managing social stresses within Mayan society, and turned into one of managing the collapsing relationship between Mayan society and the natural systems that supported it. This turned what had been an adaptive strategy into a disastrously maladaptive one, as resources and labor that might have been put to use in the struggle to maintain a failing agricultural system went instead to a final spasm of massive construction projects. This time, Kukulcan was not pleased, and Mayan civilization came apart in a rolling collapse that turned a proud civilization into crumbling ruins.

Rationalists might suggest that this is what happens to a civilization that tries to manage its economic affairs by means of superstitions. That may be so, but the habit in question didn’t die out with the classic Mayan civilization; it’s alive and well today, with a slight difference. Ancient cultures built huge pyramids of stone; we build even vaster pyramids of money.

In Cardano’s Cosmos, a thoughtful study of the life and times of the great Renaissance astrologer Girolamo Cardano, historian Anthony Grafton tried to explain the role of astrologers as advisers to Renaissance governments by comparing them to economists in today’s world. Plausible as this comparison may seem at first glance, I have to say that it is deeply unfair to astrologers. Whether or not astrology works as advertised – a question I don’t propose to address here – no competent astrologer claims that the Sun will rise in the west or that Jupiter will swing between the Earth and the Moon. By contrast, it’s not hard to find economists blithely insisting, as many did during the recent housing bubble, that a speculative frenzy can keep on inflating forever, or claiming, as many are doing right now, that a nation can make itself prosperous by running up mountains of debt.

Economics is our modern superstition – well, one of them, at any rate, and one of the most popular among the political class of today’s industrial societies. Like any other superstition, it has a core of pragmatic wisdom to it, but that core has been overlaid with a great deal of somewhat questionable logic. My wife’s Welsh ancestors believed that the bowl of milk on the back stoop pleased the fairies, and that’s why the rats stayed away from the kitchen garden; the economists of the twentieth century believed that expanding the money supply pleased – well, the prosperity fairies, or something not too dissimilar – and that’s why depressions stayed away from the United States.

In both cases it’s arguable that something very different was going on. The gargantuan economic boom that made America the world’s largest economy had plenty of causes; the accident of political geography that kept its industrial hinterlands from becoming war zones, while most other industrial nations got the stuffing pounded out of them, had more than a little to do with the matter; but the crucial point, one too often neglected in studies of twentieth century history, was the simple fact that the United States at midcentury produced more petroleum than all the other countries on Earth put together. The oceans of black gold on which the US floated to victory in two world wars defined the economic reality of an epoch. As a result, most of what passed for economic policy in the last sixty years or so amounted to attempts to figure out how to make use of unparalleled abundance.

That’s still what today’s economists are trying to do, using pretty much the same habits they adopted during the zenith of the age of oil. The problem is that this is no longer what economists need to be doing. With the coming of peak oil and the first slow slippages in worldwide conventional petroleum production, the challenge facing today’s industrial societies is managing the end of abundance. The age of cheap abundant energy now ending was a dramatic anomaly in historical terms, though not quite unprecedented; every so often, but rarely, it happens that a human society finds itself free from natural limits to prosperity and expansion – for a time. That time always ends, and the society has to relearn the lessons of more normal and less genial times. This is what we need to do now.

This is exactly what today’s economics is unprepared to do, however. Like the Mayan elite at the beginning of what archeologists call the Terminal Classic period, our political classes are trying to meet unfamiliar problems with overfamiliar solutions. The results have not been good. Repeated attempts to overcome economic stagnation by expanding access to credit have produced a series of destructive speculative bubbles and crashes, and efforts to maintain an inflated standard of living in the face of a slowly contracting real economy have heaped up gargantuan debts. These measures haven’t worked; the one significant attempt to do something different, the neoconservative project to invade Iraq and put its oil reserves in American hands, was even less successful; and at this point fingerpointing and frantic pedaling in place seems to have replaced any more constructive response to a situation that is becoming more dangerous by the day.

Are there constructive things that could be done? Of course, but every one of them flies in the face of the currently accepted economic superstitions, and most of them also involve requiring the people who benefit disproportionately from the current state of things to give up some of their perquisites – not exactly a winning bet at a time when political power has become so diffuse in most industrial nations that some pressure group or other can be counted on to veto any attempt at systemic change. I’ve already suggested several possible steps in this blog – replacing income and sales taxes with resource and interest taxes; making corporations subject to nonfinancial penalties for criminal acts; reinventing urban and suburban agriculture; tilting tax policy to encourage single-income families; rebuilding the household economy, and more – but I’ve done so in the full awareness that none of these things are going to be discussed in the corridors of government any time soon. Those that will happen at all, will happen because they can be set in motion by individuals, families, and local communities; those that can’t be pursued on that level – well, let’s just say I’m not holding my breath.

The act of faith that leads policy makers today to think that policies that failed last year will succeed next year is only part of the problem, of course. The superstitions that lead so many intelligent people to think that our problems can be solved by pursuing a flotilla of new and expensive technological projects are another part. There are technologies that can help us right now, granted, but they’re on the other end of the spectrum from the fusion reactors and solar satellites and plans to turn all of Nevada into one big algae farm that get so much attention today. Local, resilient, sustainable, and cheap: those should be our keywords just now; there are plenty of technological solutions that answer to that description, but again, our superstitions stand in the way.

The widespread reaction to the Eyjafjallajokull eruption, for that matter, points up what may just be the most deeply rooted of our superstitions, the belief that Nature can be ignored with impunity. It’s only fair to point out that for most people in the industrial world, for most of a century now, this has been true more often than not; the same exuberant abundance that produced ski slopes in Dubai and fresh strawberries in British supermarkets in January made it reasonable, for a while, to act as though whatever Nature tossed our way could be brushed aside. In the emerging postabundance age, though, this may be the most dangerous superstition of all. The tide of cheap abundant energy that has defined our attitudes as much as our technologies is ebbing now, and we are rapidly losing the margin of error that made our former arrogance possible.

As that change unfolds, it might be worth suggesting that it’s time to discard our current superstitions concerning economics, energy, and nature, and replace them with some more functional approach to these things. A superstition, once again, is an observance that has become detached from its meaning, and one of the more drastic ways this detachment can take place is a change in the circumstances that make that meaning relevant. This has arguably happened to our economic convictions, and to a great many more of the commonplaces of modern thought; and it’s simply our bad luck, so to speak, that the consequences of pursuing those superstitions in the emerging world of scarcity and contraction are likely to be considerably more destructive than those of planting by the signs or leaving a dish of milk on the back step.

Most volcanic eruptions don’t do this, but Eyjafjallajokull – say that three times very fast – happens to be under a glacier. (It is located in a country called Iceland, after all.) Or, rather, it used to be under a glacier; bring molten lava into contact with a glacier and you don’t have a glacier for long. What you have instead is what volcanologists call a phreatic eruption and the rest of us call a steam explosion. Rinse (with lava) and repeat, and you get two things. The first is a stratosphere full of fine sandpaper grit; the second is most of a continent flailing helplessly as one of its transportation networks shuts down for several days.

The human reaction was instructive. One of my regular readers commented that his wife, who works in the travel industry, has been deluged by calls from irate travelers who seem convinced that she can make the ash go away with a couple of phone calls. An EU commissioner was caught in public saying that long distance tourism was an inalienable human right, while airlines demanded that governments compensate them for the closure of the skies; at least they had the grace not to demand the money from Iceland. Meanwhile Great Britain, which gets most of its fruit and much of its vegetables from the Third World by air, was facing the prospect of bare shelves in the grocery stores for the first time since the aftermath of the Second World War.

It’s been a while since we’ve had so clear a reminder that the intricate and fragile clockwork of industrial society depends so completely on Nature’s whims, but as usual, most people managed not to get the memo. Me, I didn’t give it much thought, since I was reading a different and more familiar memo, the one brought every spring by lengthening days and the waning risk of frost. I was out in the garden planting bush beans, dwarf peas, and Danvers carrots, since the weather was warm and the Moon was in a fertile sign.

Yes, I plant by the signs. I originally learned that habit out in the Pacific Northwest, where very few people do it, and it’s ironic that I ended up moving to the Appalachians, where most gardeners keep an eye on the almanac when choosing planting dates. Do I think it works? A lot depends on what’s meant by that rather facile question. It certainly doesn’t do any harm; my gardens get good results at least as reliably as those of my neighbors, and it’s no particular inconvenience to check the signs when deciding when to plant the next round of seeds. I don’t know for a fact that it helps, but then the same thing could be said for many other things I do in the garden. (I’m more interesting in growing vegetables than in proving a point, so I don’t deprive part of my garden of compost, say, to find out whether putting my kitchen wastes in the compost bin rather than a landfill makes as much difference as it seems.) Besides, planting by the signs has entertainment value: I’ve come to enjoy the theatrics the habit attracts from rationalists who get incensed by anything they consider superstitious.

Of course they’re quite correct that planting by the signs is a superstition, but that word has a subtler meaning than most people remember these days. A superstition is literally something “standing over” (in Latin, super stitio) from a previous age; more precisely, it’s an observance that has become detached from its meaning over time. A great many of today’s superstitions thus descend from the religious observances of archaic faiths. When my wife’s Welsh grandmother set a dish of milk outside the back door for luck, for example, she likely had no idea that her pagan ancestors did the same thing as an offering to the local tutelary spirits.

Yet there’s often a remarkable substrate of ecological common sense interwoven with such rites. If your livelihood depends on the fields around your hut, for example, and rodents are among the major threats you face, a ritual that will attract cats and other small predators to the vicinity of your back door night after night is not exactly foolish. The Japanese country folk who consider foxes the messengers of Inari the rice god, and put out offerings of fried tofu to attract them, are mixing agricultural ecology with folk religion in exactly the same way.

There’s a lot of this sort of thing in the world of superstition. I have long since lost the reference, but many years ago I read an ecological study of human hunting practices, which pointed out that nearly all cultures that get much of their food from the hunt use divination to decide where to hunt on any given day. The authors pointed out that according to game theory, the best strategy in any competition has to include a random element in order to keep the other side guessing. Most prey animals are quite clever enough to figure out a nonrandom pattern of hunting – there’s a reason why deer across America head into suburbs and towns, where hunting isn’t allowed, as soon as hunting season opens each year – so inserting a random factor into hunting strategy will pay off in increased kills over time. As far as we know, humans are the only animals that make decisions with the aid of horoscopes, tarot cards, yarrow stalks and the like, and it’s intriguing to think that this habit may have had a significant role in our evolutionary success.

Is this all there is to the practice of superstition? It’s a good question, and one that’s effectively impossible to answer. For all I know, all those ancient civilizations that built vast piles of stone to the honor of their gods may have been right to say that Marduk, Osiris, Kukulcan et al. were well pleased by having big temples erected in their honor, and reciprocated by granting peace and prosperity to their worshippers. It may just be a coincidence that channeling the boisterous energy of young men into some channel more constructive than civil war is a significant social problem in most civilizations, and giving them big blocks of stone to haul around in teams, in hot competition with other teams, seems to do the trick; it may also be a coincidence that convincing the very rich to spend their wealth employing huge numbers of laborers on vanity buildings provides a steady boost to even the simplest urban economy. Maybe this is how Kukulcan shows that he’s well pleased.

Still, there’s a wild card in the deck, because it’s possible for even the most useful superstition to become a major source of problems when conditions change. When the Mayan civilization overshot the carrying capacity of its fragile environment, the Mayan elite responded to the rising spiral of crisis by building more and bigger temples. That had worked in the past, but it failed to work this time, because the situation was different; the problem had stopped being one of managing social stresses within Mayan society, and turned into one of managing the collapsing relationship between Mayan society and the natural systems that supported it. This turned what had been an adaptive strategy into a disastrously maladaptive one, as resources and labor that might have been put to use in the struggle to maintain a failing agricultural system went instead to a final spasm of massive construction projects. This time, Kukulcan was not pleased, and Mayan civilization came apart in a rolling collapse that turned a proud civilization into crumbling ruins.

Rationalists might suggest that this is what happens to a civilization that tries to manage its economic affairs by means of superstitions. That may be so, but the habit in question didn’t die out with the classic Mayan civilization; it’s alive and well today, with a slight difference. Ancient cultures built huge pyramids of stone; we build even vaster pyramids of money.

In Cardano’s Cosmos, a thoughtful study of the life and times of the great Renaissance astrologer Girolamo Cardano, historian Anthony Grafton tried to explain the role of astrologers as advisers to Renaissance governments by comparing them to economists in today’s world. Plausible as this comparison may seem at first glance, I have to say that it is deeply unfair to astrologers. Whether or not astrology works as advertised – a question I don’t propose to address here – no competent astrologer claims that the Sun will rise in the west or that Jupiter will swing between the Earth and the Moon. By contrast, it’s not hard to find economists blithely insisting, as many did during the recent housing bubble, that a speculative frenzy can keep on inflating forever, or claiming, as many are doing right now, that a nation can make itself prosperous by running up mountains of debt.

Economics is our modern superstition – well, one of them, at any rate, and one of the most popular among the political class of today’s industrial societies. Like any other superstition, it has a core of pragmatic wisdom to it, but that core has been overlaid with a great deal of somewhat questionable logic. My wife’s Welsh ancestors believed that the bowl of milk on the back stoop pleased the fairies, and that’s why the rats stayed away from the kitchen garden; the economists of the twentieth century believed that expanding the money supply pleased – well, the prosperity fairies, or something not too dissimilar – and that’s why depressions stayed away from the United States.

In both cases it’s arguable that something very different was going on. The gargantuan economic boom that made America the world’s largest economy had plenty of causes; the accident of political geography that kept its industrial hinterlands from becoming war zones, while most other industrial nations got the stuffing pounded out of them, had more than a little to do with the matter; but the crucial point, one too often neglected in studies of twentieth century history, was the simple fact that the United States at midcentury produced more petroleum than all the other countries on Earth put together. The oceans of black gold on which the US floated to victory in two world wars defined the economic reality of an epoch. As a result, most of what passed for economic policy in the last sixty years or so amounted to attempts to figure out how to make use of unparalleled abundance.

That’s still what today’s economists are trying to do, using pretty much the same habits they adopted during the zenith of the age of oil. The problem is that this is no longer what economists need to be doing. With the coming of peak oil and the first slow slippages in worldwide conventional petroleum production, the challenge facing today’s industrial societies is managing the end of abundance. The age of cheap abundant energy now ending was a dramatic anomaly in historical terms, though not quite unprecedented; every so often, but rarely, it happens that a human society finds itself free from natural limits to prosperity and expansion – for a time. That time always ends, and the society has to relearn the lessons of more normal and less genial times. This is what we need to do now.

This is exactly what today’s economics is unprepared to do, however. Like the Mayan elite at the beginning of what archeologists call the Terminal Classic period, our political classes are trying to meet unfamiliar problems with overfamiliar solutions. The results have not been good. Repeated attempts to overcome economic stagnation by expanding access to credit have produced a series of destructive speculative bubbles and crashes, and efforts to maintain an inflated standard of living in the face of a slowly contracting real economy have heaped up gargantuan debts. These measures haven’t worked; the one significant attempt to do something different, the neoconservative project to invade Iraq and put its oil reserves in American hands, was even less successful; and at this point fingerpointing and frantic pedaling in place seems to have replaced any more constructive response to a situation that is becoming more dangerous by the day.

Are there constructive things that could be done? Of course, but every one of them flies in the face of the currently accepted economic superstitions, and most of them also involve requiring the people who benefit disproportionately from the current state of things to give up some of their perquisites – not exactly a winning bet at a time when political power has become so diffuse in most industrial nations that some pressure group or other can be counted on to veto any attempt at systemic change. I’ve already suggested several possible steps in this blog – replacing income and sales taxes with resource and interest taxes; making corporations subject to nonfinancial penalties for criminal acts; reinventing urban and suburban agriculture; tilting tax policy to encourage single-income families; rebuilding the household economy, and more – but I’ve done so in the full awareness that none of these things are going to be discussed in the corridors of government any time soon. Those that will happen at all, will happen because they can be set in motion by individuals, families, and local communities; those that can’t be pursued on that level – well, let’s just say I’m not holding my breath.

The act of faith that leads policy makers today to think that policies that failed last year will succeed next year is only part of the problem, of course. The superstitions that lead so many intelligent people to think that our problems can be solved by pursuing a flotilla of new and expensive technological projects are another part. There are technologies that can help us right now, granted, but they’re on the other end of the spectrum from the fusion reactors and solar satellites and plans to turn all of Nevada into one big algae farm that get so much attention today. Local, resilient, sustainable, and cheap: those should be our keywords just now; there are plenty of technological solutions that answer to that description, but again, our superstitions stand in the way.

The widespread reaction to the Eyjafjallajokull eruption, for that matter, points up what may just be the most deeply rooted of our superstitions, the belief that Nature can be ignored with impunity. It’s only fair to point out that for most people in the industrial world, for most of a century now, this has been true more often than not; the same exuberant abundance that produced ski slopes in Dubai and fresh strawberries in British supermarkets in January made it reasonable, for a while, to act as though whatever Nature tossed our way could be brushed aside. In the emerging postabundance age, though, this may be the most dangerous superstition of all. The tide of cheap abundant energy that has defined our attitudes as much as our technologies is ebbing now, and we are rapidly losing the margin of error that made our former arrogance possible.

As that change unfolds, it might be worth suggesting that it’s time to discard our current superstitions concerning economics, energy, and nature, and replace them with some more functional approach to these things. A superstition, once again, is an observance that has become detached from its meaning, and one of the more drastic ways this detachment can take place is a change in the circumstances that make that meaning relevant. This has arguably happened to our economic convictions, and to a great many more of the commonplaces of modern thought; and it’s simply our bad luck, so to speak, that the consequences of pursuing those superstitions in the emerging world of scarcity and contraction are likely to be considerably more destructive than those of planting by the signs or leaving a dish of milk on the back step.

Wednesday, April 14, 2010

A Blindness to Systems

“I feel my fate in what I cannot fear,” poet Theodore Roethke wrote in his most famous poem, “The Waking.” He could have been speaking for any of us; as individuals, communities, or societies, it’s not the problems we dread but the ones we’re unable to take seriously, or fail to recognize as problems at all, that end up dragging us down.

Some of the responses to last week’s Archdruid Report post brought that point forcefully home to me. The theme of that post, as regular readers will remember, is that it’s meaningless to talk about the efficiency of machines vis-a-vis human beings unless the costs of the whole system needed to produce, maintain, and operate the machines is compared to the costs of the whole system needed to do the same for the human beings. In response to the post, a flurry of critics on and off the comments page of this blog presented arguments that simply ignored the system costs I’d spent the entire post discussing. I would have had no complaints if they’d disagreed with my analysis, or even argued against the inclusion of system costs altogether – the logic of dissensus, the deliberate cultivation of divergent strategies, is as relevant to my work as it is anywhere else – but that’s not what they did. Instead, they acted as though the issue of system costs had never been raised at all.

It’s a fascinating lapse of reason, and it keeps on surfacing in contemporary discussions of the deindustrial future. The recurrent debates on the future of the internet here on The Archdruid Report come forcefully to mind. The point I’ve made there is that the survival of the internet doesn’t depend on whether maintaining some form of internet is technically possible in a post-peak world, on the one hand, and desirable on the other; it depends on whether the internet will be able to pay for itself, and successfully compete for scarce dollars against lower-tech ways of sending letters and selling porn, in a future when energy and resources are costly and harshly limited, while human labor is abundant and cheap.

With unnerving predictability, in turn, those who want to dispute my suggestion simply insist that the internet will survive because it’s technically feasible in a post-peak world, on the one hand, and desirable on the other. They don’t challenge the economic issue; they don’t address it at all; they simply raise their voices and talk even more loudly about the technical feasibility and desirability of the internet. What makes this all the more intriguing is that these are not stupid people; one and all, they’re bright and, at least by the standards of the present age, well-educated; catch them on this one point, though, and the result is a mental equivalent of the famous Blue Screen of Death.

From a broader perspective, this same inability to think about whole systems pervades contemporary industrial culture. You don’t have to go as far as the dwindling community of space-colony fans to find good examples, though that’s one I’ll be discussing down the road a bit; just notice how many people seem to believe that all the garbage and pollution they generate goes to a mythical place called “Away,” or that the Earth will provide us with an infinite supply of crude oil if we just keep drilling holes in her. (“We can’t be out of petroleum, we’ve still got drilling rigs left.”) For that matter, the paralogical thinking that drives speculative bubbles – if everybody is going to get rich by investing in the gimmick du jour, what does that suggest will happen to the value of money? – has rarely if ever been as popular as it is in modern America, and it depends as completely on a blindness to the implications of whole systems as any of the points I’ve mentioned.

I’d like to discuss another example at this point, though, because it bears directly on one of the central themes I’ve been developing here in recent months. What would you say, dear reader, if I told you that I’ve come up with a way to eliminate unemployment in the United States – yes, even in the face of the current economic mess? What if I explained that it would also improve the effective standard of living of many American families and decrease their income tax burdens? And that it would also increase our economic resilience and sustainability, and simultaneously cause a significant decrease in the amount of automobile traffic on America’s streets and highways? Would you be all for it?

No, dear reader, you wouldn’t. Permit me to explain why.

Right now, many two-income families with children in the United States are caught in a very curious economic bind. I haven’t been able to find statistics, but I personally know quite a few families for whom the cost of paid child care and one partner’s costs for commuting, business clothes, and all the other expenses of employment, approaches or even exceeds the take-home pay of one partner. Factor in the benefits of shifting to a lower tax bracket, and for a great many of these families, becoming a single-income family with one partner staying out of the paid work force would actually result in an increase in disposable income each month.

This is even before factoring in the financial elephant in the living room of the old one-income family: the economic benefits of the household economy. It’s only in the last half dozen decades that the home has become nothing more than a center of consumption; before then, it was a place where real wealth was produced. It costs a great deal less to buy the raw materials for meals than to pick up something from the supermarket deli on the way home from work, as so many people do these days, or to fill the pantry and the fridge with prepackaged processed food; it costs a great deal less to buy yarn than to purchase socks and afghans of anything like the quality a good knitter can make; it costs a great deal less to grow a good fraction of a family’s vegetables in a backyard garden than to buy them fresh at the grocery, if you can get them at all.

The difference in each case – and examples like this could be multiplied manyfold – is made by the household economy. Economists like to dismiss the household economy as inefficient, but it’s worth remembering that “efficiency” in current economic jargon is defined as labor efficiency – that is an economic process is considered more efficient if it uses less human labor, no matter how wildly inefficent it is in any other sense. Economists also like to dismiss the household economy because it lacks economies of scale, and here they’re on firmer ground. Still, there’s another factor that more than counterbalances this; much of the value of an employee’s labor – as much, as Marxists like to remind us, as the employer can get away with taking – goes to support his employer, while all of the value produced by labor in the household market remains with the family and is used directly, without being mediated through the money economy.

This is why, until quite recently, at least half the adult members of most families, aside from the urban poor, worked in the household economy instead of the money economy. It’s also why a grandparent or two or an unmarried aunt so often found a place in the family setting. This had very little to do with charity; an extra pair of hands that could be employed in the household economy was a significant economic asset to most families. One of the advantages of this, of course, is that elderly people continued to have a valued and productive role in their families and communities, instead of being paid to go away and do nothing until they die, as so many of them are today.

None of these things are any less possible today than they were in the 1920s, or for that matter the 1820s. As a former househusband, I can say this on the basis of personal experience; my wife and I found that we had a better standard of living on her bookkeeper’s salary alone, with a thriving full time household economy, than we had earlier on two salaries with only the scraps of a household economy the two of us could manage after work and commuting. I came in for a certain amount of derision for making that choice, of course, though it’s only fair to say that I got off very lightly in comparison to the abuse leveled, mostly by women, at those women I knew who made a similar decision.

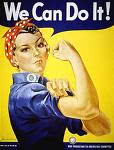

Now of course that touches on one of the most volatile issues touching on the household economy, the politics of gender. For complex cultural reasons, a great many feminists in the 1960s and 1970s came to believe that working for one’s family in the household economy was a form of slavery, while working for an employer in the money economy – often under conditions that were even more exploitative – was a form of liberation. Now it’s certainly true that assigning people to participation in the household economy by gender was unfair, but it’s equally true that assigning them to participation in the money economy on the same basis was no better; for every woman whose talents were wasted in a housewife’s role, there was arguably a man whose life would have been much happier and more productive had he had the option of working full time in the household economy.

Feminism might usefully have challenged the relative social status assigned to the household and money economies, and pressed for a revaluation of work and gender that could have thrown open a much broader field of possibilities to people of both genders; and in fact some thoughtful steps were taken in this direction by a few perceptive thinkers in the movement. In general, though, that turned out to be the road not taken. Instead, the great majority of women simply accepted the social value given to participation in the money economy, demanded access to it for themselves, and got it. In the process, for most Americans, the household economy collapsed, or survived only as a dowdy sort of hobby practiced by the insufficiently fashionable.

Let’s grant at the outset, therefore, that there’s no particular reason why people of one gender ought to be more active in the household economy than people of the other; let’s assume that a great many men will make the choice I did, and work full time in the household economy while the women in their lives work full time for a paycheck. On that basis, is there a point to two-income families shifting gears and becoming families that combine one cash income with a productive household economy? Of course there is, and now more than ever.

To begin with, as already mentioned, a significant number of families with children would gain an immediate boost in their disposable income each month by taking the kids home from daycare, giving up the second commute (and in some cases, the second car as well), dropping the other expenses that come with paid employment, and taking a wild downhill ride through the income tax brackets. A great many more would find that when these benefits are combined with the real wealth produced by the household economy, they came out well ahead. Even those who simply broke even would be likely to find that differences in quality, though hard to measure in strictly economic terms, would make the change more than worthwhile.

Now take a moment to think of the effects on community and society. Take a significant amount of the workforce out of paid employment, and two things happen: first, unemployment rates go down, and second, competition among employers for the remaining workers tends to drive wages up. Some sectors of the economy would be negatively affected, to be sure; sales of convenience foods would decrease, and so would employment in the day care industry, among others; still, these industries would be affected by the contraction in workforce numbers along with all the others, and those employees who needed to find a job elsewhere would be entering a job market where their chances would be much better than they are at present. There would need to be some adjustments, especially to retirement arrangements, but those are going to have to happen fairly soon anyway.

Finally, factor in the impact of such a change on the resilience and sustainability of society. A nation in which a very large fraction of the workforce is insulated from the money economy, and produces a diverse array of goods and services at home for local consumption using relatively simple tools, is a nation that’s much better prepared to face the economic turmoil of the end of the age of cheap oil than a nation where nearly everyone depends for their income, as well as for the goods and services they use every day, on the global economy. A nation in which, let’s say, 30% fewer people have to drive to work than they do today is much better prepared to face the price spikes and shortages that will almost inevitably affect gasoline and other petroleum products in the years to come. A nation in which doing things for yourself again has a recognized social value is much better prepared for a future in which we will have to do much more for ourselves than most people can imagine just now.

So when can we expect the return of the single-income family to become an element of constructive plans for the post-peak future? When will Transition Town programs, let’s say, match up the experienced elderly with novice househusbands and housewives who want to learn how to cook, sew, can, garden, and knit? When will high-profile liberal couples start throwing parties to announce that one member of the pair is quitting paid employment, so that the poor have an easier job market and a better chance at upward mobility? When will people aggressively lobby their congressflacks to get a sizable income tax deduction and special Social Security arrangements for families with one income?

Let’s just say I’m not going to hold my breath. In fact, dear reader, I’m quite confident that even if you belong to that large group of married couples with children who could increase your disposable income by giving up that second job, you won’t do it; in fact, you won’t even run the numbers to see whether it would work for you – and the reason you won’t is that you’re so mesmerized by that monthly check of $2000 a month take-home, or whatever it happens to be, that you can’t imagine giving it up even if you have to spend $2200 a month to get it. That is to say, dear reader, that if you don’t think in terms of whole systems, the fact that the system costs of that second job might just outweigh the benefits will be as incomprehensible to you as a computer would have been to a medieval peasant.

The extraordinary blindness to whole systems that pervades our collective consciousness these days is a fairly recent thing – as recently as the 1970s, talk about system costs got far fewer blank stares and non sequiturs than it does today – and I doubt it will last long in historical terms, if only because the hard edge of Darwinian selection separates adaptive cultural forms from maladaptive ones with the same ruthlessness it applies to genetics. While it remains in place, it will likely cause a great deal of damage, but that in itself will tend to accelerate its replacement with some less dysfunctional habit of thought. Ironically, the Theodore Roethke poem with which I started this post offers a cogent reminder of that. It begins:

I wake to sleep, and take my waking slow.

I feel my fate in what I cannot fear.

I learn by going where I have to go.

We will all, I think, learn a great deal by going where we have to go during the lean and challenging years to come. The hope that we might manage to learn a thing or two in advance of that journey is understandable enough, and the thing has happened now and then in history; still, for reasons already discussed, that hope seems very frail to me just now.

Some of the responses to last week’s Archdruid Report post brought that point forcefully home to me. The theme of that post, as regular readers will remember, is that it’s meaningless to talk about the efficiency of machines vis-a-vis human beings unless the costs of the whole system needed to produce, maintain, and operate the machines is compared to the costs of the whole system needed to do the same for the human beings. In response to the post, a flurry of critics on and off the comments page of this blog presented arguments that simply ignored the system costs I’d spent the entire post discussing. I would have had no complaints if they’d disagreed with my analysis, or even argued against the inclusion of system costs altogether – the logic of dissensus, the deliberate cultivation of divergent strategies, is as relevant to my work as it is anywhere else – but that’s not what they did. Instead, they acted as though the issue of system costs had never been raised at all.

It’s a fascinating lapse of reason, and it keeps on surfacing in contemporary discussions of the deindustrial future. The recurrent debates on the future of the internet here on The Archdruid Report come forcefully to mind. The point I’ve made there is that the survival of the internet doesn’t depend on whether maintaining some form of internet is technically possible in a post-peak world, on the one hand, and desirable on the other; it depends on whether the internet will be able to pay for itself, and successfully compete for scarce dollars against lower-tech ways of sending letters and selling porn, in a future when energy and resources are costly and harshly limited, while human labor is abundant and cheap.

With unnerving predictability, in turn, those who want to dispute my suggestion simply insist that the internet will survive because it’s technically feasible in a post-peak world, on the one hand, and desirable on the other. They don’t challenge the economic issue; they don’t address it at all; they simply raise their voices and talk even more loudly about the technical feasibility and desirability of the internet. What makes this all the more intriguing is that these are not stupid people; one and all, they’re bright and, at least by the standards of the present age, well-educated; catch them on this one point, though, and the result is a mental equivalent of the famous Blue Screen of Death.

From a broader perspective, this same inability to think about whole systems pervades contemporary industrial culture. You don’t have to go as far as the dwindling community of space-colony fans to find good examples, though that’s one I’ll be discussing down the road a bit; just notice how many people seem to believe that all the garbage and pollution they generate goes to a mythical place called “Away,” or that the Earth will provide us with an infinite supply of crude oil if we just keep drilling holes in her. (“We can’t be out of petroleum, we’ve still got drilling rigs left.”) For that matter, the paralogical thinking that drives speculative bubbles – if everybody is going to get rich by investing in the gimmick du jour, what does that suggest will happen to the value of money? – has rarely if ever been as popular as it is in modern America, and it depends as completely on a blindness to the implications of whole systems as any of the points I’ve mentioned.

I’d like to discuss another example at this point, though, because it bears directly on one of the central themes I’ve been developing here in recent months. What would you say, dear reader, if I told you that I’ve come up with a way to eliminate unemployment in the United States – yes, even in the face of the current economic mess? What if I explained that it would also improve the effective standard of living of many American families and decrease their income tax burdens? And that it would also increase our economic resilience and sustainability, and simultaneously cause a significant decrease in the amount of automobile traffic on America’s streets and highways? Would you be all for it?

No, dear reader, you wouldn’t. Permit me to explain why.

Right now, many two-income families with children in the United States are caught in a very curious economic bind. I haven’t been able to find statistics, but I personally know quite a few families for whom the cost of paid child care and one partner’s costs for commuting, business clothes, and all the other expenses of employment, approaches or even exceeds the take-home pay of one partner. Factor in the benefits of shifting to a lower tax bracket, and for a great many of these families, becoming a single-income family with one partner staying out of the paid work force would actually result in an increase in disposable income each month.

This is even before factoring in the financial elephant in the living room of the old one-income family: the economic benefits of the household economy. It’s only in the last half dozen decades that the home has become nothing more than a center of consumption; before then, it was a place where real wealth was produced. It costs a great deal less to buy the raw materials for meals than to pick up something from the supermarket deli on the way home from work, as so many people do these days, or to fill the pantry and the fridge with prepackaged processed food; it costs a great deal less to buy yarn than to purchase socks and afghans of anything like the quality a good knitter can make; it costs a great deal less to grow a good fraction of a family’s vegetables in a backyard garden than to buy them fresh at the grocery, if you can get them at all.

The difference in each case – and examples like this could be multiplied manyfold – is made by the household economy. Economists like to dismiss the household economy as inefficient, but it’s worth remembering that “efficiency” in current economic jargon is defined as labor efficiency – that is an economic process is considered more efficient if it uses less human labor, no matter how wildly inefficent it is in any other sense. Economists also like to dismiss the household economy because it lacks economies of scale, and here they’re on firmer ground. Still, there’s another factor that more than counterbalances this; much of the value of an employee’s labor – as much, as Marxists like to remind us, as the employer can get away with taking – goes to support his employer, while all of the value produced by labor in the household market remains with the family and is used directly, without being mediated through the money economy.

This is why, until quite recently, at least half the adult members of most families, aside from the urban poor, worked in the household economy instead of the money economy. It’s also why a grandparent or two or an unmarried aunt so often found a place in the family setting. This had very little to do with charity; an extra pair of hands that could be employed in the household economy was a significant economic asset to most families. One of the advantages of this, of course, is that elderly people continued to have a valued and productive role in their families and communities, instead of being paid to go away and do nothing until they die, as so many of them are today.

None of these things are any less possible today than they were in the 1920s, or for that matter the 1820s. As a former househusband, I can say this on the basis of personal experience; my wife and I found that we had a better standard of living on her bookkeeper’s salary alone, with a thriving full time household economy, than we had earlier on two salaries with only the scraps of a household economy the two of us could manage after work and commuting. I came in for a certain amount of derision for making that choice, of course, though it’s only fair to say that I got off very lightly in comparison to the abuse leveled, mostly by women, at those women I knew who made a similar decision.

Now of course that touches on one of the most volatile issues touching on the household economy, the politics of gender. For complex cultural reasons, a great many feminists in the 1960s and 1970s came to believe that working for one’s family in the household economy was a form of slavery, while working for an employer in the money economy – often under conditions that were even more exploitative – was a form of liberation. Now it’s certainly true that assigning people to participation in the household economy by gender was unfair, but it’s equally true that assigning them to participation in the money economy on the same basis was no better; for every woman whose talents were wasted in a housewife’s role, there was arguably a man whose life would have been much happier and more productive had he had the option of working full time in the household economy.

Feminism might usefully have challenged the relative social status assigned to the household and money economies, and pressed for a revaluation of work and gender that could have thrown open a much broader field of possibilities to people of both genders; and in fact some thoughtful steps were taken in this direction by a few perceptive thinkers in the movement. In general, though, that turned out to be the road not taken. Instead, the great majority of women simply accepted the social value given to participation in the money economy, demanded access to it for themselves, and got it. In the process, for most Americans, the household economy collapsed, or survived only as a dowdy sort of hobby practiced by the insufficiently fashionable.

Let’s grant at the outset, therefore, that there’s no particular reason why people of one gender ought to be more active in the household economy than people of the other; let’s assume that a great many men will make the choice I did, and work full time in the household economy while the women in their lives work full time for a paycheck. On that basis, is there a point to two-income families shifting gears and becoming families that combine one cash income with a productive household economy? Of course there is, and now more than ever.

To begin with, as already mentioned, a significant number of families with children would gain an immediate boost in their disposable income each month by taking the kids home from daycare, giving up the second commute (and in some cases, the second car as well), dropping the other expenses that come with paid employment, and taking a wild downhill ride through the income tax brackets. A great many more would find that when these benefits are combined with the real wealth produced by the household economy, they came out well ahead. Even those who simply broke even would be likely to find that differences in quality, though hard to measure in strictly economic terms, would make the change more than worthwhile.

Now take a moment to think of the effects on community and society. Take a significant amount of the workforce out of paid employment, and two things happen: first, unemployment rates go down, and second, competition among employers for the remaining workers tends to drive wages up. Some sectors of the economy would be negatively affected, to be sure; sales of convenience foods would decrease, and so would employment in the day care industry, among others; still, these industries would be affected by the contraction in workforce numbers along with all the others, and those employees who needed to find a job elsewhere would be entering a job market where their chances would be much better than they are at present. There would need to be some adjustments, especially to retirement arrangements, but those are going to have to happen fairly soon anyway.

Finally, factor in the impact of such a change on the resilience and sustainability of society. A nation in which a very large fraction of the workforce is insulated from the money economy, and produces a diverse array of goods and services at home for local consumption using relatively simple tools, is a nation that’s much better prepared to face the economic turmoil of the end of the age of cheap oil than a nation where nearly everyone depends for their income, as well as for the goods and services they use every day, on the global economy. A nation in which, let’s say, 30% fewer people have to drive to work than they do today is much better prepared to face the price spikes and shortages that will almost inevitably affect gasoline and other petroleum products in the years to come. A nation in which doing things for yourself again has a recognized social value is much better prepared for a future in which we will have to do much more for ourselves than most people can imagine just now.

So when can we expect the return of the single-income family to become an element of constructive plans for the post-peak future? When will Transition Town programs, let’s say, match up the experienced elderly with novice househusbands and housewives who want to learn how to cook, sew, can, garden, and knit? When will high-profile liberal couples start throwing parties to announce that one member of the pair is quitting paid employment, so that the poor have an easier job market and a better chance at upward mobility? When will people aggressively lobby their congressflacks to get a sizable income tax deduction and special Social Security arrangements for families with one income?

Let’s just say I’m not going to hold my breath. In fact, dear reader, I’m quite confident that even if you belong to that large group of married couples with children who could increase your disposable income by giving up that second job, you won’t do it; in fact, you won’t even run the numbers to see whether it would work for you – and the reason you won’t is that you’re so mesmerized by that monthly check of $2000 a month take-home, or whatever it happens to be, that you can’t imagine giving it up even if you have to spend $2200 a month to get it. That is to say, dear reader, that if you don’t think in terms of whole systems, the fact that the system costs of that second job might just outweigh the benefits will be as incomprehensible to you as a computer would have been to a medieval peasant.

The extraordinary blindness to whole systems that pervades our collective consciousness these days is a fairly recent thing – as recently as the 1970s, talk about system costs got far fewer blank stares and non sequiturs than it does today – and I doubt it will last long in historical terms, if only because the hard edge of Darwinian selection separates adaptive cultural forms from maladaptive ones with the same ruthlessness it applies to genetics. While it remains in place, it will likely cause a great deal of damage, but that in itself will tend to accelerate its replacement with some less dysfunctional habit of thought. Ironically, the Theodore Roethke poem with which I started this post offers a cogent reminder of that. It begins:

I wake to sleep, and take my waking slow.

I feel my fate in what I cannot fear.

I learn by going where I have to go.

We will all, I think, learn a great deal by going where we have to go during the lean and challenging years to come. The hope that we might manage to learn a thing or two in advance of that journey is understandable enough, and the thing has happened now and then in history; still, for reasons already discussed, that hope seems very frail to me just now.

Wednesday, April 07, 2010

The Twilight of the Machine

The end of the age of cheap abundant energy, as last week’s Archdruid Report argued, brings with it an unavoidable reshaping of our most basic ideas about economics and, in particular, economic development. For the last three centuries or so, the effective meaning of this phrase has centered on the replacement of human labor by machines. All the other measures of development – and of course plenty of them have been offered down through the years – either reflect or presuppose that basic economic shift.

The replacement of labor with mechanical energy has even come to play a potent role in the popular imagination. From the machine-assisted living of The Jetsons to the darker image of reality itself as a machine-created illusion in The Matrix, the future has come to be defined as a place where people do even less work with their own muscles than they do today. All this is the product of what an earlier post called the logic of abundance: the notion, rooted right down in the core of the contemporary worldview of industrial society, that there will always be enough resources to let people have whatever it is that they think they want.