I have yet to hear anyone in the peak oil blogosphere mention the name of Captain Gustaf Erikson of the Åland Islands and his fleet of windjammers. For all I know, he’s been completely forgotten now, his name and accomplishments packed away in the same dustbin of forgotten history as solar steam-engine pioneer Augustin Mouchot, his near contemporary. If so, it’s high time that his footsteps sounded again on the quarterdeck of our collective imagination, because his story—and the core insight that committed him to his lifelong struggle—both have plenty to teach about the realities framing the future of technology in the wake of today’s era of fossil-fueled abundance.

Erikson, born in 1872, grew up in a seafaring family and went to sea as a ship’s boy at the age of nine. At 19 he was the skipper of a coastal freighter working the Baltic and North Sea ports; two years later he shipped out as mate on a windjammer for deepwater runs to Chile and Australia, and eight years after that he was captain again, sailing three- and four-masted cargo ships to the far reaches of the planet. A bad fall from the rigging in 1913 left his right leg crippled, and he left the sea to become a shipowner instead, buying the first of what would become the 20th century’s last major fleet of windpowered commercial cargo vessels.

It’s too rarely remembered these days that the arrival of steam power didn’t make commercial sailing vessels obsolete across the board. The ability to chug along at eight knots or so without benefit of wind was a major advantage in some contexts—naval vessels and passenger transport, for example—but coal was never cheap, and the long stretches between coaling stations on some of the world’s most important trade routes meant that a significant fraction of a steamship’s total tonnage had to be devoted to coal, cutting into the capacity to haul paying cargoes. For bulk cargoes over long distances, in particular, sailing ships were a good deal more economical all through the second half of the 19th century, and some runs remained a paying proposition for sail well into the 20th.

That was the niche that the windjammers of the era exploited. They were huge—up to 400 feet from stem to stern—square-sided, steel-hulled ships, fitted out with more than an acre of canvas and miles of steel-wire rigging. They could be crewed by a few dozen sailors, and hauled prodigious cargoes: up to 8,000 tons of Australian grain, Chilean nitrate—or, for that matter, coal; it was among the ironies of the age that the coaling stations that allowed steamships to refuel on long voyages were very often kept stocked by tall ships, which could do the job more economically than steamships themselves could. The markets where wind could outbid steam were lucrative enough that at the beginning of the 20th century, there were still thousands of working windjammers hauling cargoes across the world’s oceans.

That didn’t change until bunker oil refined from petroleum ousted coal as the standard fuel for powered ships. Petroleum products carry much more energy per pound than even the best grade of coal, and the better grades of coal were beginning to run short and rise accordingly in price well before the heyday of the windjammers was over. A diesel-powered vessel had to refuel less often, devote less of its tonnage to fuel, and cost much less to operate than its coal-fired equivalent. That’s why Winston Churchill, as head of Britain’s Admiralty, ordered the entire British Navy converted from coal to oil in the years just before the First World War, and why coal-burning steamships became hard to find anywhere on the seven seas once the petroleum revolution took place. That’s also why most windjammers went out of use around the same time; they could compete against coal, but not against dirt-cheap diesel fuel.

Gustav Erikson went into business as a shipowner just as that transformation was getting under way. The rush to diesel power allowed him to buy up windjammers at a fraction of their former price—his first ship, a 1,500-ton bark, cost him less than $10,000, and the pride of his fleet, the four-masted Herzogin Cecilie, set him back only $20,000. A tight rein on operating expenses and a careful eye on which routes were profitable kept his firm solidly in the black. The bread and butter of his business came from shipping wheat from southern Australia to Europe; Erikson’s fleet and the few other windjammers still in the running would leave European ports in the northern hemisphere’s autumn and sail for Spencer Gulf on Australia’s southern coast, load up with thousands of tons of wheat, and then race each other home, arriving in the spring—a good skipper with a good crew could make the return trip in less than 100 days, hitting speeds upwards of 15 knots when the winds were right.

There was money to be made that way, but Erikson’s commitment to the windjammers wasn’t just a matter of profit. A sentimental attachment to tall ships was arguably part of the equation, but there was another factor as well. In his latter years, Erikson was fond of telling anyone who would listen that a new golden age for sailing ships was on the horizon: sooner or later, he insisted, the world’s supply of coal and oil would run out, steam and diesel engines would become so many lumps of metal fit only for salvage, and those who still knew how to haul freight across the ocean with only the wind for power would have the seas, and the world’s cargoes, all to themselves.

Those few books that mention Erikson at all like to portray him as the last holdout of a departed age, a man born after his time. On the contrary, he was born before his time, and lived too soon. When he died in 1947, the industrial world’s first round of energy crises were still a quarter century away, and only a few lonely prophets had begun to grasp the absurdity of trying to build an enduring civilization on the ever-accelerating consumption of a finite and irreplaceable fuel supply. He had hoped that his sons would keep the windjammers running, and finish the task of getting the traditions and technology of the tall ships through the age of fossil fuels and into the hands of the seafarers of the future. I’m sorry to say that that didn’t happen; the profits to be made from modern freighters were too tempting, and once the old man was gone, his heirs sold off the windjammers and replaced them with diesel-powered craft.

Erikson’s story is worth remembering, though, and not simply because he was an early prophet of what we now call peak oil. He was also one of the very first people in our age to see past the mythology of technological progress that dominated the collective imagination of his time and ours, and glimpse the potentials of one of the core strategies this blog has been advocating for the last eight years.

We can use the example that would have been dearest to his heart, the old technology of windpowered maritime cargo transport, to explore those potentials. To begin with, it’s crucial to remember that the only thing that made tall ships obsolete as a transport technology was cheap abundant petroleum. The age of coal-powered steamships left plenty of market niches in which windjammers were economically more viable than steamers. The difference, as already noted, was a matter of energy density—that’s the technical term for how much energy you get out of each pound of fuel; the best grades of coal have only about half the energy density of petroleum distillates, and as you go down the scale of coal grades, energy density drops steadily.

The brown coal that’s commonly used for fuel these days provides, per pound, rather less than a quarter the heat energy you get from a comparable weight of bunker oil.

As the world’s petroleum reserves keep sliding down the remorseless curve of depletion, in turn, the price of bunker oil—like that of all other petroleum products—will continue to move raggedly upward. If Erikson’s tall ships were still in service, it’s quite possible that they would already be expanding their market share; as it is, it’s going to be a while yet before rising fuel costs will make it economical for shipping firms to start investing in the construction of a new generation of windjammers. Nonetheless, as the price of bunker oil keeps rising, it’s eventually going to cross the line at which sail becomes the more profitable option, and when that happens, those firms that invest in tall ships will profit at the expense of their old-fahioned, oil-burning rivals.

Yes, I’m aware that this last claim flies in the face of one of the most pervasive superstitions of our time, the faith-based insistence that whatever technology we happen to use today must always and forever be better, in every sense but a purely sentimental one, than whatever technology it replaced. The fact remains that what made diesel-powered maritime transport standard across the world’s oceans was not some abstract superiority of bunker oil over wind and canvas, but the simple reality that for a while, during the heyday of cheap abundant petroleum, diesel-powered freighters were more profitable to operate than any of the other options. It was always a matter of economics, and as petroleum depletion tilts the playing field the other way, the economics will change accordingly.

All else being equal, if a shipping company can make larger profits moving cargoes by sailing ships than by diesel freighters, coal-burning steamships, or some other option, the sailing ships will get the business and the other options will be left to rust in port. It really is that simple. The point at which sailing vessels become economically viable, in turn, is determined partly by fuel prices and partly by the cost of building and outfitting a new generation of sailing ships. Erikson’s plan was to do an end run around the second half of that equation, by keeping a working fleet of windjammers in operation on niche routes until rising fuel prices made it profitable to expand into other markets. Since that didn’t happen, the lag time will be significantly longer, and bunker fuel may have to price itself entirely out of certain markets—causing significant disruptions to maritime trade and to national and regional economies—before it makes economic sense to start building windjammers again.

It’s a source of wry amusement to me that when the prospect of sail transport gets raised, even in the greenest of peak oil circles, the immediate reaction from most people is to try to find some way to smuggle engines back onto the tall ships. Here again, though, the issue that matters is economics, not our current superstitious reverence for loud metal objects. There were plenty of ships in the 19th century that combined steam engines and sails in various combinations, and plenty of ships in the early 20th century that combined diesel engines and sails the same way. Windjammers powered by sails alone were more economical than either of these for long-range bulk transport, because engines and their fuel supplies cost money, they take up tonnage that can otherwise be used for paying cargo, and their fuel costs cut substantially into profits as well.

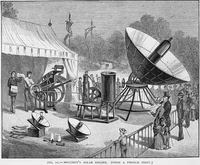

For that matter, I’ve speculated in posts here about the possibility that Augustin Mouchot’s solar steam engines, or something like them, could be used as a backup power source for the windjammers of the deindustrial future. It’s interesting to note that the use of renewable energy sources for shipping in Erikson’s time wasn’t limited to the motive power provided by sails; coastal freighters of the kind Erikson skippered when he was nineteen were called “onkers” in Baltic Sea slang, because their windmill-powered deck pumps made a repetitive “onk-urrr, onk-urrr” noise. Still, the same rule applies; enticing as it might be to imagine sailors on a becalmed windjammer hauling the wooden cover off a solar steam generator, expanding the folding reflector, and sending steam down belowdecks to drive a propeller, whether such a technology came into use would depend on whether the cost of buying and installing a solar steam engine, and the lost earning capacity due to hold space being taken up by the engine, was less than the profit to be made by getting to port a few days sooner.

Are there applications where engines are worth having despite their drawbacks? Of course. Unless the price of biodiesel ends up at astronomical levels, or the disruptions ahead along the curve of the Long Descent cause diesel technology to be lost entirely, tugboats will probably have diesel engines for the imaginable future, and so will naval vessels; the number of major naval battles won or lost in the days of sail because the wind blew one way or another will doubtless be on the minds of many as the age of petroleum winds down. Barring a complete collapse in technology, in turn, naval vessels will no doubt still be made of steel—once cannons started firing explosive shells instead of solid shot, wooden ships became deathtraps in naval combat—but most others won’t be; large-scale steel production requires ample supplies of coke, which is produced by roasting coal, and depletion of coal supplies in a postpetroleum future guarantees that steel will be much more expensive compared to other materials than it is today, or than it was during the heyday of the windjammers.

Note that here again, the limits to technology and resource use are far more likely to be economic than technical. In purely technical terms, a maritime nation could put much of its arable land into oil crops and use that to keep its merchant marine fueled with biodiesel. In economic terms, that’s a nonstarter, since the advantages to be gained by it are much smaller than the social and financial costs that would be imposed by the increase in costs for food, animal fodder, and all other agricultural products. In the same way, the technical ability to build an all-steel merchant fleet will likely still exist straight through the deindustrial future; what won’t exist is the ability to do so without facing prompt bankruptcy. That’s what happens when you have to live on the product of each year’s sunlight, rather than drawing down half a billion years of fossil photosynthesis:

there are hard economic limits to how much of anything you can produce, and increasing production of one thing pretty consistently requires cutting production of something else. People in today’s industrial world don’t have to think like that, but their descendants in the deindustrial world will either learn how to do so or perish.

This point deserves careful study, as it’s almost always missed by people trying to think their way through the technological consequences of the deindustrial future. One reader of mine who objected to talk about abandoned technologies in a previous post quoted with approval the claim, made on another website, that if a deindustrial society can make one gallon of biodiesel, it can make as many thousands or millions of gallons as it wants. Technically, maybe; economically, not a chance. It’s as though you made $500 a week and someone claimed you could buy as many bottles of $100-a-bottle scotch as you wanted; in any given week, your ability to buy expensive scotch would be limited by your need to meet other expenses such as food and rent, and some purchase plans would be out of reach even if you ignored all those other expenses and spent your entire paycheck at the liquor store. The same rule applies to societies that don’t have the windfall of fossil fuels at their disposal—and once we finish burning through the fossil fuels we can afford to extract, every human society for the rest of our species’ time on earth will be effectively described in those terms.

The one readily available way around the harsh economic impacts of fossil fuel depletion is the one that Gunnar Erikson tried, but did not live to complete—the strategy of keeping an older technology in use, or bringing a defunct technology back into service, while there’s still enough wealth sloshing across the decks of the industrial economy to make it relatively easy to do so. I’ve suggested above that if his firm had kept the windjammers sailing, scraping out a living on whatever narrow market niche they could find, the rising cost of bunker oil might already have made it profitable to expand into new niches; there wouldn’t have been the additional challenge of finding the money to build new windjammers from the keel up, train crews to sail them, and get ships and crews through the learning curve that’s inevitably a part of bringing an unfamiliar technology on line.

That same principle has been central to quite a few of this blog’s projects. One small example is the encouragement I’ve tried to give to the rediscovery of the slide rule as an effective calculating device. There are still plenty of people alive today who know how to use slide rules, plenty of books that teach how to crunch numbers with a slipstick, and plenty of slide rules around. A century down the line, when slide rules will almost certainly be much more economically viable than pocket calculators, those helpful conditions might not be in place—but if people take up slide rules now for much the same reasons that Erikson kept the tall ships sailing, and make an effort to pass skills and slipsticks on to another generation, no one will have to revive or reinvent a dead technology in order to have quick accurate calculations for practical tasks such as engineering, salvage, and renewable energy technology.

The collection of sustainable-living skills I somewhat jocularly termed “green wizardry,” which I learned back in the heyday of the appropriate tech movement in the late 1970s and early 1980s, passed on to the readers of this blog in a series of posts a couple of years ago, and have now explored in book form as well, is another case in point. Some of that knowledge, more of the attitudes that undergirded it, and nearly all the small-scale, hands-on, basement-workshop sensibility of the movement in question has vanished from our collective consciousness in the years since the Reagan-Thatcher counterrevolution foreclosed any hope of a viable future for the industrial world. There are still enough books on appropriate tech gathering dust in used book shops, and enough in the way of living memory among those of us who were there, to make it possible to recover those things; another generation and that hope would have gone out the window.

There are plenty of other possibilities along the same lines. For that matter, it’s by no means unreasonable to plan on investing in technologies that may not be able to survive all the way through the decline and fall of the industrial age, if those technologies can help cushion the way down. Whether or not it will still be possible to manufacture PV cells at the bottom of the deindustrial dark ages, as I’ve been pointing out since the earliest days of this blog, getting them in place now on a home or local community scale is likely to pay off handsomely when grid-based electricity becomes unreliable, as it will. The modest amounts of electricity you can expect to get from this and other renewable sources can provide critical services (for example, refrigeration and long-distance communication) that will be worth having as the Long Descent unwinds.